Forex metatrader 4 is a trading platform that offers a variety of features to help you make the most of your trades. Both beginners and professionals can download the software for free. It comes with numerous tutorials and educational resources to assist you in using the platform.

MT4 can both be used on Windows or Mac computers. It also supports a range of financial instruments and can be used for trading on forex, CFDs, shares, precious metals and stock indices.

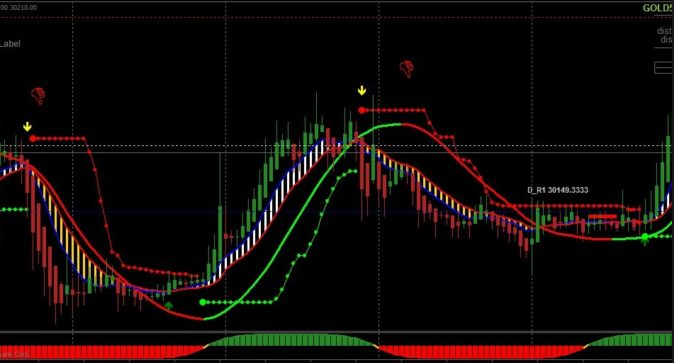

The platform features a market analysis tool, which allows you to make informed decisions about trades and determine when the best time is to enter or exit them. It allows you to create automated orders that will be executed based upon your criteria.

MetaTrader 4 allows you to create your own indicators, scripts, and robots using the MQL4 programming syntax. If you are interested in learning how to code for MetaTrader 4, this can be a great way to improve your trading skills.

MT4 is a popular platform for forex trading. It allows you to purchase and sell currencies as well as trade them for other assets. It is compatible with most smartphones, tablets, and can be accessed from anywhere in the globe.

When you're ready to start trading, it's important to choose the right broker and the best trading platform. This will allow you to maximize your trading potential, and increase your profit. You should also be sure to read reviews and learn more about each broker before you sign up for an account.

A reliable broker will provide a user ID, password, and other information that allows you to trade. You can also get help setting up your trading accounts or handling any problems you might have. Some brokers may charge fees and offer limited customer support. You should therefore shop around before you choose a broker.

A lot of brokers offer a MetaTrader4 demo account for free to get you started in the market. These demo accounts are a great way to test your trading strategies before you commit real money.

This platform is popular with both novice and experienced traders. It's very easy to use and includes the ability for robots to automate your trades. It's a great way for you to keep track of trades without needing to monitor the charts all day.

Set up alerts that will notify you when certain price levels are reached or missed. This can help you to ensure that your trades are entered or exited on the correct prices and in the right time. This will allow you to save money and avoid missing profitable trades.

FAQ

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

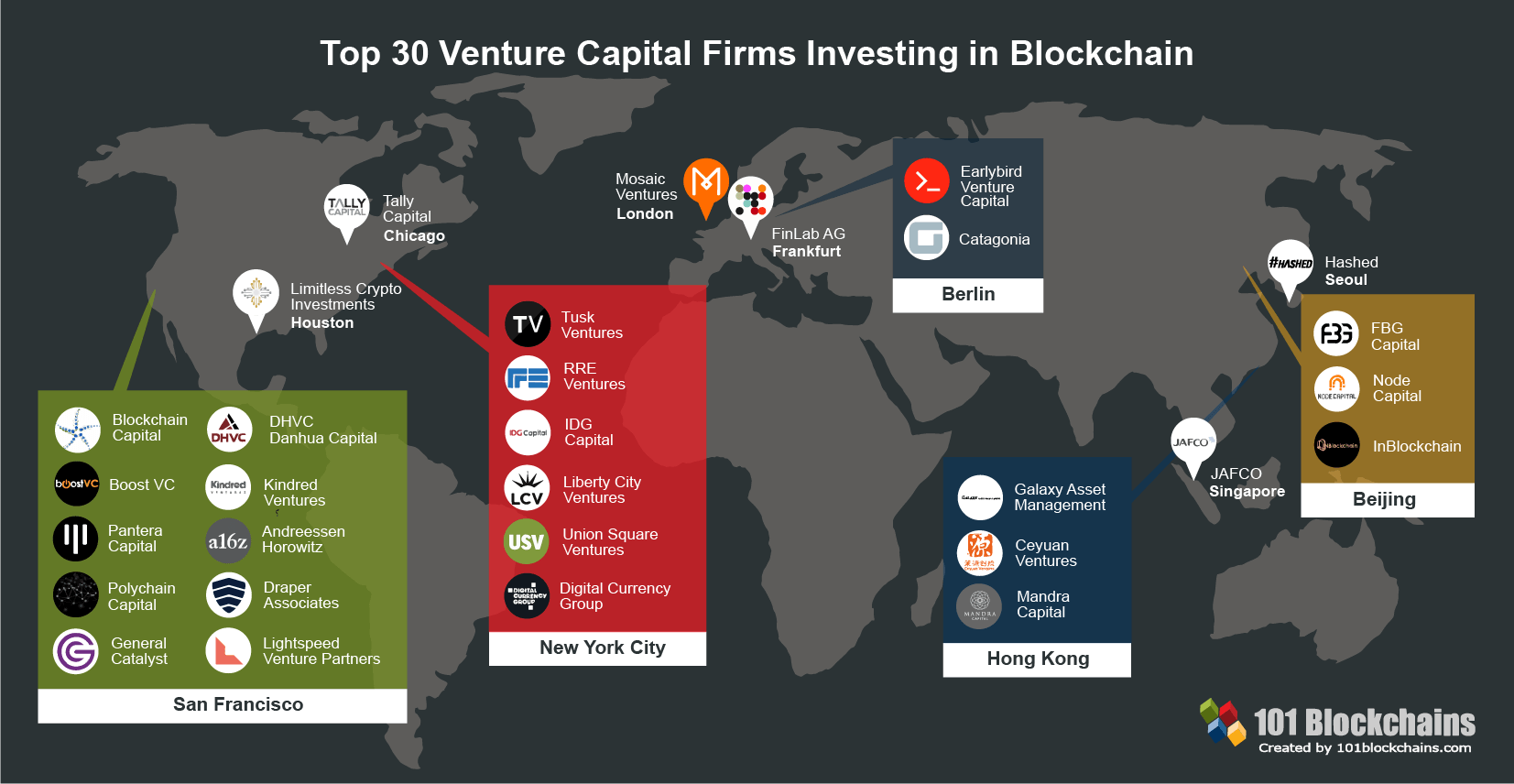

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

First, you need to know that there are many ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which trading site for beginners is the best?

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Knowing how to spot price patterns can help you predict where the market will go. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts must be secure. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, ensure the platform you are using is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Third, you need to know the terms of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Review and rate the platform and see what other users think. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will ensure your online investment account is protected against any possible threats.