Dow futures are financial futures based on the Dow Jones industrial average. These futures allow investors to speculate about the future value an index and lock into a buy or sale price. To be successful traders must understand the risks. You will need to open an account with a reliable brokerage if you wish to invest in the Dow futures markets. It is important to know more about the trading process in order to decide if after-hours trades are right for you.

After-hours trades offer traders flexibility and convenience. It is possible to quickly respond to news in the morning, and then trade. A stock might be offered at a price that is attractive during non-market hours. But, if your trading skills aren't up to par, you might lose your investment.

The US and European markets close around 9:30 p.m. Eastern Time, and the Asian market opens at 09:30 a.m. Your risk will change overnight depending upon the market. Some traders prefer to trade between 9 a.m. (EST) and 11 a.m., when volatility can be high and prices of assets may drastically shift between their closing and opening price. This is due to the fact that underlying equities change throughout the day.

Investors are drawn to the liquidity offered by index futures, as well the possibility to hedge positions. Typically, index futures are leveraged, which means that you have the option of holding the assets you buy or sell for less than the full price. This is a good option for active traders but should be avoided by those who are new to after-hours trades.

When it comes to Dow futures, you can choose between E-Mini and Mini Dow futures. E-Mini contracts, which can be electronically traded, are only a fraction the S&P 500 standard contract. These futures trade on CME Globex, one of the world's largest trading platforms. Both options allow you to trade large volumes and offer high leverage.

There are many options for futures, so it is important that you consider your personal preferences and risk tolerance. The trading strategy you use, the risk of the investment and how you wish to position yourself in the market are all factors that will influence whether you go into the after-hours or not.

While you may be more at risk, after-hours traders can provide flexibility and convenience. You can trade by opening an account with a brokerage company and choosing the best products. A reliable brokerage can help with all your trading requirements. Even if there is no plan to use the market after hours, it is a good idea opening an account to be able to access many tools and services. Trading and research tools are available that will help you stay ahead.

FAQ

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it is important that you understand the risks as well as the rewards.

Do forex traders make money?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is more secure, forex or crypto?

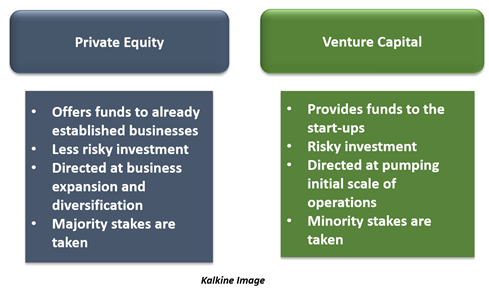

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Forex and Cryptocurrencies are great investments.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Don't respond to unsolicited calls or emails. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before making any commitments, investigate all investment options thoroughly and independently.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Never forget that scammers will try any means to steal your personal data. You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

Secure online investment platforms are also essential. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.