The lives of billions worldwide are influenced by commodity markets. Not only are they a place for investors, but they also provide diversification and hedging to other financial markets. There are many types of commodities, including food articles, ag products, metals, energy, and even raw materials like sugar, wheat, and soy. There are many ways traders can participate in the market, despite its complexity.

First, it is important to recognize that the commodity market is not all or nothing. Some commodities such as crude oil are heavily weighted towards one end of this scale. This is due in part to the fact that some oil refining units have had to remain closed because of the Arctic freeze. This has led to lower prices.

An online broker is a great way to start your own business. Reputable brokers will give you detailed data and a dedicated analyst to help with your decision making. It is a good idea for your broker to conduct a risk assessment. If you don't know much about investing in commodities, it might be worth seeking advice.

It is hard to estimate how much money you can expect to make. The best strategy is to use data for educated decisions. Surprised to discover that the price rise of crude oil has a dead cat bounce?

One of the most difficult challenges for the ag industry is distribution of ag related goods and services. Much of this activity occurs in a highly fragmented, illiquid marketplace. These factors can lead to a less than ideal outcome for farmers. Thankfully, some of the major players in the ag space are taking steps to mitigate this problem.

Although the commodity markets have been a major player within the financial sector in recent years, they are still subject to government policies. A number of reforms were introduced in India, for instance. India is also strengthening its existing institutions for derivatives trade.

It is worth noting that even small companies can take advantage of the commodity market. A small manufacturer could buy one or two totes from the exchange, and then pay a fair price. Larger companies may buy bulk oil on spot market at a comparable price.

The most fascinating thing about the commodity marketplace is, however, that it's fun. You'll be able to learn how to maximize your returns by following the right strategies, which are outlined in the book Commodity Investing. You'll learn a lot of smart investment strategies that will allow you to make more in a competitive financial market.

As with any other venture, the commodity market isn't for the faint of heart. It is not surprising that gold has surged in anticipation that the US Federal Reserve will reduce its rate-hiking cycle. Silver is not faring as well.

FAQ

Forex traders can make money

Forex traders can make good money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many other investment options available.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Is Cryptocurrency a Good Investment?

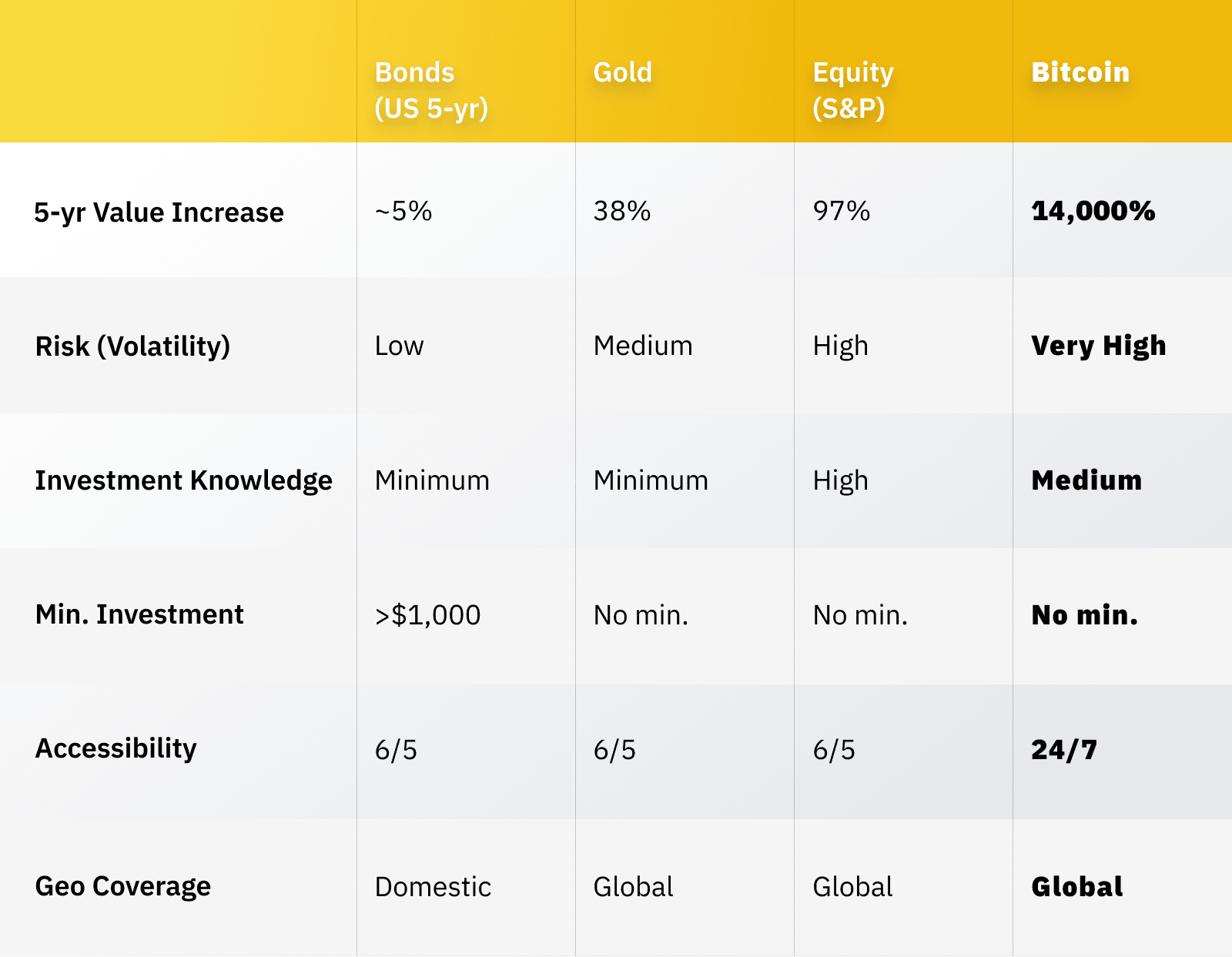

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When investing online, research is essential. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

You should understand the investment risk profile and be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.