Whether you're just starting out or an experienced investor, there are several important traits that you should look for in day trading stocks. These traits include price volatility and liquidity as well as trends.

Volatility is the degree to which a security's value changes. High levels of volatility can cause stock prices to fluctuate across a broad range of value, which presents an opportunity for day trader. When choosing a stock, make sure that the volatility is high enough to be a good fit for your needs.

Traders can take advantage of price movements by buying a volatile stock at a low price and selling when the value increases. This strategy allows you to generate a higher profit per share than long-term traders while also reducing your risk.

There are many stocks to choose from. But these trading picks for the next day are best for you, the type of trader that you are. These stocks have three traits in common: they have been trending at least for a year, they are well-known worldwide, and they provide substantial value for your investment. Each one of these attributes will give you an advantage over the rest.

Tesla is an excellent stock because it is one of the biggest electric vehicle manufacturers. There are several divisions within the company that focus on autonomous vehicles and sustainable energies. It's also frequently featured in the news. The stock's performance may be affected by Elon Musk's tweets.

Another stock with a lot of hype is AMC Networks, which is a global entertainment company. Its share has increased by 2000% within a short period of time. This is remarkable considering that the company was founded at $2 in 2021. The company is gaining momentum with a market value of more than $24 billion.

Netflix is another streaming company that has been very popular. With over 200 million subscribers, the company provides a variety of award-winning movies and TV shows. Netflix's service is also available in multiple languages, giving it a vast global reach. And with increased demand for streaming services, Netflix's share is sure to continue growing.

Finally, Nektar Therapeutics is high-volatility and can see price spikes. The stock fluctuates a lot, even though the company makes many options. In fact, it's a great stock for any trader's portfolio.

NIO is one among the most traded stocks. It is a company which is accelerating product innovation to meet the EV boom. They are working closely with partners to grow their supply chain. And they will be launching new vehicles in the next year. NIO's growth plan is focused on increasing sales coverage.

DocuSign is an innovative company that focuses on building solutions for a variety of industries. Their software allows users to electronically make agreements. They also develop lightweight materials for corporations. In recent years, the company has seen its profits rise and continues to innovate its products. DocuSign is a great way to increase your return on investment.

FAQ

Frequently Asked Fragen

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

How do I invest in Bitcoin

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

First, you need to know that there are many ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

What are the advantages and disadvantages of online investing?

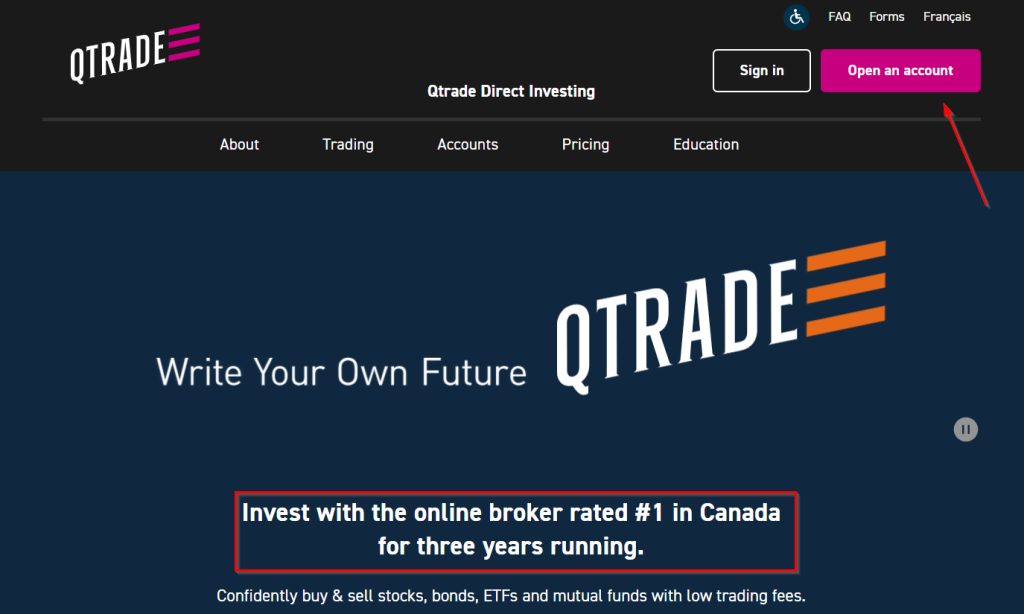

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Is Cryptocurrency Good for Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

It is important to do your research before investing online. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Be skeptical of promises of substantial future returns or future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!