Agricultural commodities, which are essential for human life, are traded around the world. The demand for these commodities is constantly increasing, and they are expected to continue growing in the future. There are many factors that can cause these commodities to fluctuate in price, including political and economic disruptions.

Therefore, it is essential to learn about agricultural commodities and how they can be traded effectively. Agri-trading is a great way diversify your portfolio, and to invest. You can also earn more by agri trading.

Many trading firms trade agricultural commodities. These trading companies are licensed and regulated by relevant authorities. These companies offer a wide variety of services to traders. They offer technical support, trading strategy, and other tools that can help you make informed choices.

Some trading companies also have research teams. They can provide reports and data regarding the various factors that affect agricultural product prices.

These companies can provide information and tips on the best times to purchase and sell products. These companies will help you determine the correct amount of margin to place on each transaction.

The world's largest agricultural commodities market is vitally important. Understanding its workings is key. It is important to understand the different trading platforms and brokers available in this industry.

One of the most popular ways to trade agricultural commodities is through futures contracts. They are traded on a range of markets, and can be used by both beginners and experienced traders alike.

A number of companies are based here and specialize in trading agricultural commodities. They are well-known for their transparency and reliability, as well as having a lot of experience.

Global agri-food trade is growing, and there are many technological innovations that can improve it. These include electronic sanitary and phytosanitary (SPS) certification, which can save costs and time for producers and consumers.

Grain is an important crop in the global market, and it is highly in demand. Grain is used in animal feed production and is the main ingredient of foods like corn, wheat and soybeans.

There are many factors that affect the grain price, including demand, supply and production. In addition, there are trade regulations that affect the price of these crops.

Among the top agricultural commodity trading companies are Archer-Daniels-Midland Company, Wilmar International, and Bunge Limited.

In recent years, Swiss-based traders entered the agricultural market. They now focus on global value chains, mergers and acquisitions.

Traders need to be able adapt quickly to meet changing demands for agricultural commodities. They need to be able and willing to guarantee the quality of the products that they trade.

Agricultural commodities play an integral part in our lives. Since the beginning of time, they have traded on global markets. These commodities are crucial to our lives, but they can also prove unpredictable. It is crucial to keep up with all developments and news regarding the agricultural industry.

FAQ

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

Next, research any additional information you may need to feel confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

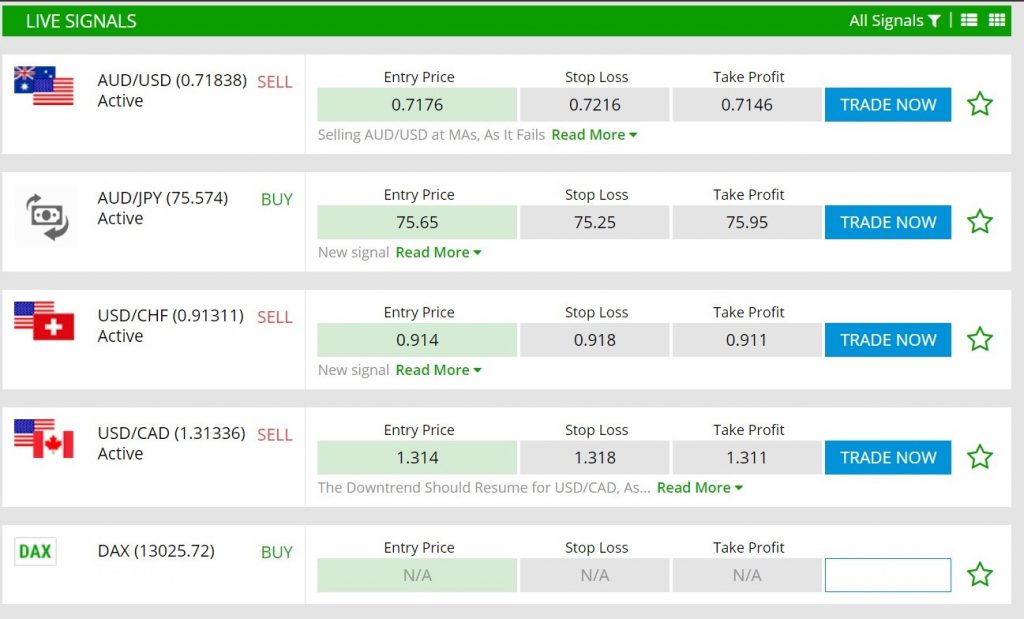

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Which is best forex trading or crypto trading?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading is easier than investing in foreign currencies upfront.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

It is important to research both sides of the coin before you make any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Frequently Asked Questions

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

There are two types of stock: preferred stock and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which trading website is best for beginners

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

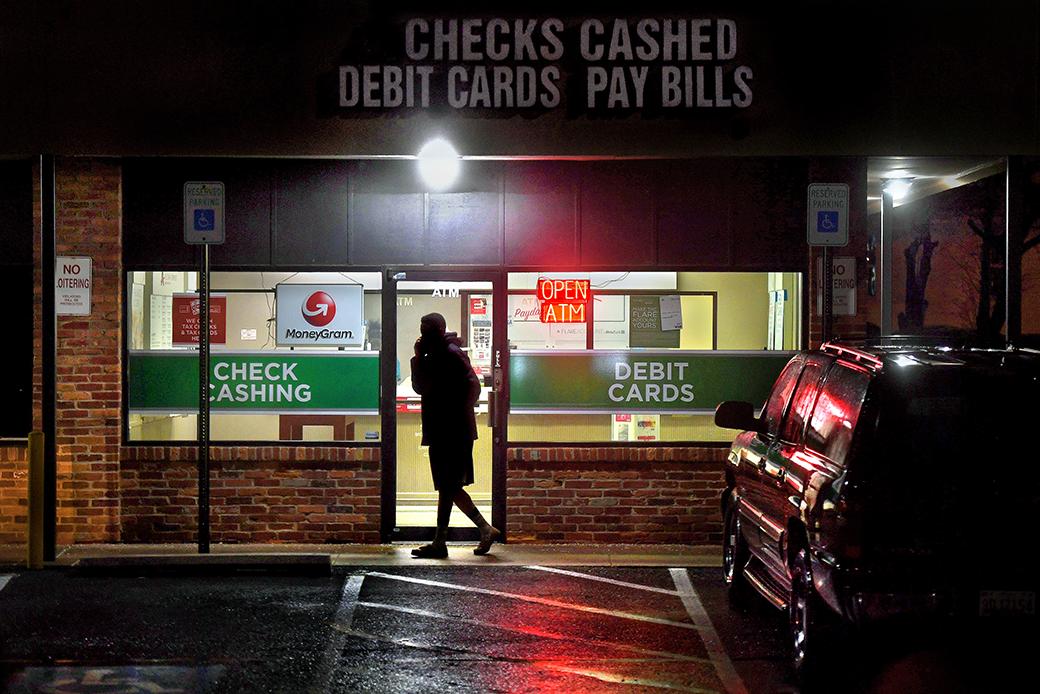

Should I store my investment assets online or do I have other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. A strong security system is essential for your valuable assets. There are several options.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

Alternately, you can keep your money in physical forms such as cash or gold. However, it is less secure and more difficult to track and requires more maintenance for storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?