There are many cryptocurrencies. Some are worthwhile to buy right now and others are not. It all depends on your risk appetite and the rest of what you have in your portfolio.

Start off with one of these popular coins if cryptocurrency is new to you. But it is best that you take your time to learn the intricacies of the cryptocurrency world before making a purchase.

One of the most popular cryptocurrencies out there is Bitcoin. It has a solid reputation and is widely accepted by many services. It is an excellent crypto-to-buy, and its price has steadily gone up over the years. You can also buy Bitcoin to hedge your portfolio's risks.

Another very popular cryptocurrency to buy is XRP. XRP (XRP Ledger) is a native cryptocurrency that is scalable and efficient. XRP's low transaction cost and speed make it ideal to use in a wide range of projects. Although XRP's price has dropped below $1, it remains a very affordable investment.

Ethereum is another fantastic crypto. This platform supports smart contracts. The developers are aiming to build a network that is secure, decentralized, and reliable. The project also has great potential. It is a prominent name in the market, boasting a market capitalization of more than $1 billion.

Cardano is another popular investment option. It is unique because it has an extremely unique consensus mechanism called Ouroboros. Cardano platform developers work continuously to improve and expand the functionality by using this system. The currency is well-known by both retail and institutional investors. XRP is supported by major banks and has seen impressive price growth.

Hedera network, while not a major player within the cryptocurrency industry is a promising one. This project offers an open-source and permissionless platform for smart contracts. This network also has a variety of services that support it, such as smart contract tools and mint tokens. Other benefits include its stability, strong community, and brand.

Many experts focus on coins with greater functionality. However, there are other cryptocurrencies that can be worth investing in. VeChain and Fantom are some of the most prominent cryptocurrencies. These coins have solid futures and are solid projects.

To make a cryptocurrency project successful, it must possess a fundamental worth. This could be a novel technology, a solution in the crypto environment, or even a means of paying for transactions. Those projects that have a clear future, and that show positive growth dynamics are often the most stable.

It is fun and rewarding to invest in cryptocurrency. Learn as much as you can about the industry. You may also discover some interesting projects that you want to invest in. However, if you find yourself tempted by the lowest possible price for a coin, it won't guarantee a profit.

FAQ

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are many options.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

How can I invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, gather any additional information to help you feel confident about your investment decision. Learning the basics of cryptocurrencies and how they work before diving in is important. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

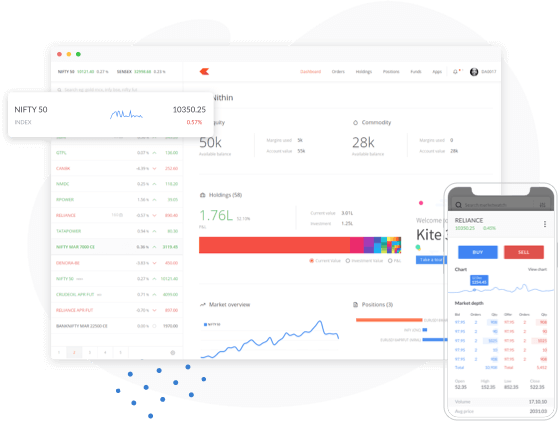

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers provide interactive tools to show you how trades function without risking any money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Money can be complex but so can the decisions about how to store it. A strong security system is essential for your valuable assets. There are several options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.