Best Penny Crypto to Invest 2022

One popular way to make a lot of money in cryptocurrency is to invest in penny cryptocurrencies. These coins are typically traded at $1 per token and are considered conservative investments, compared to larger-cap coins which can be more volatile. However, there are some great penny cryptos that have huge potential for big gains in the future and could easily double or even triple in value within a few years.

Meta Masters Guild (MEMAG).

MEMAG is a cryptocurrency offering investors the chance to join the first mobile gaming community in the world. It is supported by several innovative technologies and features that are sure to attract many investors. MEMAG's presale has already raised $1.5 million and is expected to grow.

Tamadoge

TAMAdoge offers a great opportunity for penny crypto enthusiasts to join a project that is rapidly growing in popularity. The project is currently among the top 10 most popular meme coins according to volume. It has made tremendous gains since its presale. Despite its recent downtrend TAMAdoge is poised to break out in the near future, with more development and a continuing focus on its network growth.

IBAT

The IBAT blockchain project is developing a comprehensive P2E sports game that is interconnected with the metaverse, where users can engage in various fantasy sports activities and compete against others from around the world. It also created a number utility-focused features to help users get more out of IBAT, making it one of the most promising penny crypto projects to invest in 2023.

Battle Infinity

Battle Infinity, an integrated P2E games gaming platform, has already attracted significant attention from investors. The company has a bright outlook and is expected to continue growing. Its NFT-based P2E fantasy games, such as the IBAT Premier League are a key feature. They have already received considerable interest from both crypto enthusiasts to this game.

Love and Hate Inu

This innovative, fun-filled project has been a huge success since its pre-sale. Love Hate Inu was able to raise more than $220k in three days. This revolutionary platform rewards users for taking part in polls, events, and other activities.

Chiliz

CHZ, another great option for penny-crypto investors, is also available. Chiliz offers fans a wide range of voting and fan engagement options, along with exclusive merchandise for members. The project's dynamic token burn strategy is tied to team performance. It offers club voting perks and early tickets as well other unique incentives for supporters.

eToro

eToro is an online trading platform that allows you to trade stocks, commodities, currencies, and indices on a commission-free basis. There are many markets available, including cryptocurrency, that can be traded with a variety tools. Buying and selling crypto coins through eToro are easy and safe.

FAQ

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which trading site for beginners is the best?

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Where can you invest and make daily income?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

Real estate is another option. Investing in property can provide steady returns with long-term appreciation and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Frequently Asked questions

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

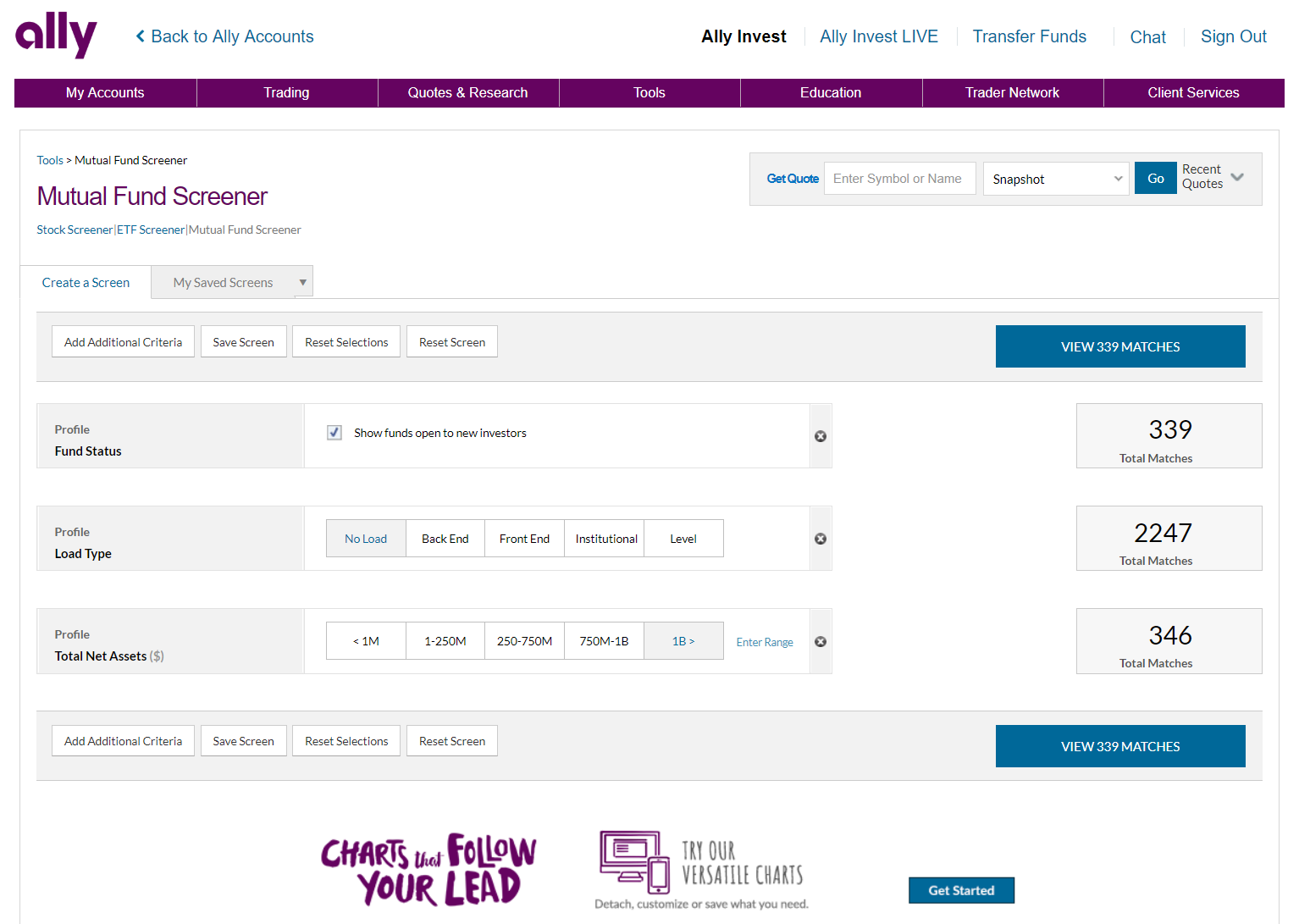

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. It is important to trade only with money you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

What are the disadvantages and advantages of online investing?

Online investing offers convenience as its main benefit. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection begins with you. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Don't respond to unsolicited calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before making any commitments, thoroughly research investment opportunities independently.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Never forget that scammers will try any means to steal your personal data. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

Secure online investment platforms are also essential. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.