It can be a great way for you to become involved in the cryptocurrency world by buying and trading nfts. It is also risky in a new space that hasn’t been well regulated. Before you begin, it is important to understand how to sell and buy NFTs.

NFT trading is selling non-fungible tokens. These digital assets don't exist physically. These can include music tracks, emojis and even basketball cards.

The NFT marketplaces are where people can purchase and sell NFTs, with these assets forming part of a digital asset portfolio that can be used for investments or other activities. NFTs may be used to support musicians and artists, access private Discord servers, make purchases on gaming sites, and other online stores.

There are many ways to sell and buy NFTs. These exchanges accept multiple types of cryptocurrencies, including Bitcoin and Ethereum.

Some exchanges limit the number of NFTs they show, while others allow trades with all cryptos. To avoid getting scammed and having your money stolen, it's important that you understand which coin your NFT is backed.

Before you buy an NFT, it is important to review the seller's license conditions. These terms can vary widely between exchanges, so read them carefully to ensure you have a clear understanding of the rights and obligations of the buyer.

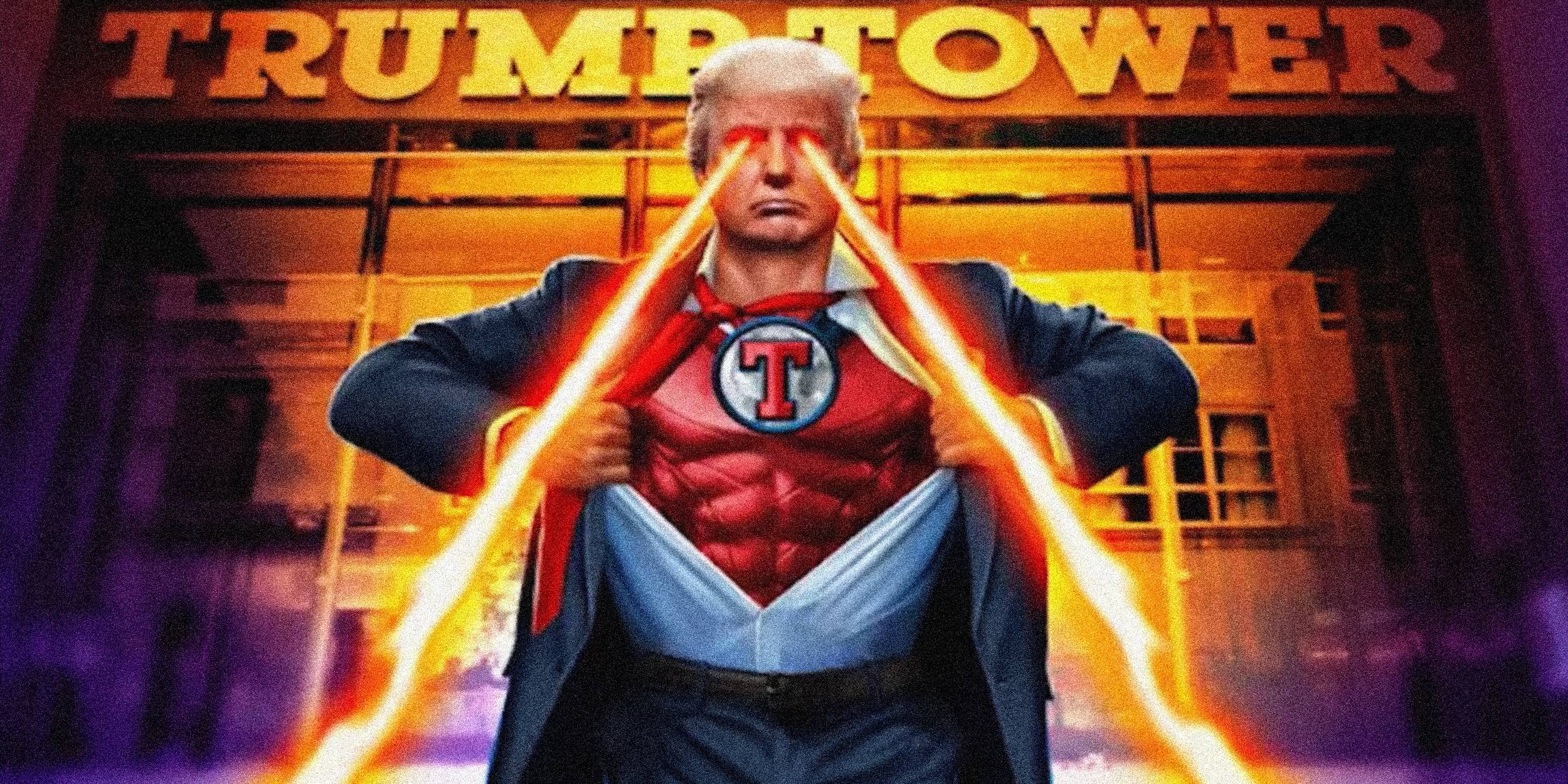

NFT trading is big business. Many celebrities and brands have entered the market to capitalize on this new source. Some are even using NFTs to promote their products and services.

For example, Taco Bell and Coca-Cola have both created NFTs as a way to boost sales. To assist their customers in finding the right nfts and collecting them, they've partnered up with NFT marketplaces.

NFTs may be extremely popular so they can be worth a lot right away. These NFTs are likely to sell for five to ten times their initial price, but they can also be resold over time.

These NFTs are usually created by the artist or licensed by companies to be sold. These NFTs could be very valuable. You should make sure that you're dealing with a legal artist or company before buying an NFT.

Although purchasing NFTs is straightforward, it's important to understand that they don't have the same value as a piece of physical art. They aren't tangible, and they can be used anywhere. If you are looking to purchase an NFT, it is a smart idea to check out the artist's social media pages or website to see how they promote their NFTs.

FAQ

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Forex and Cryptocurrencies are great investments.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Knowing how to spot price patterns can help you predict where the market will go. Also, you should only trade with money that is within your means.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing can be a great way to build your finances and earn long-term income. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Can forex traders make any money?

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

It is important to do your research before investing online. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Learn about the investment's risk profile and review the terms and condition. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Conduct due diligence checks to make sure that you're receiving what you paid for. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.