MetaTrader forex trading platform, is a popular choice. It comes with custom indicators, expert advisors, and other features. It is available both as a Web browser-based and downloadable application. This platform is suitable for both novices and experts.

The MetaTrader 5 Platform is the most advanced. This platform has been made more user-friendly and versatile. MetaTrader 5 is 12 times faster than the MetaTrader 4. It also has many more tools and indicators.

Apart from finding a trading platform that is reliable, it is also important to locate a broker. Most Forex brokers offer several platforms, but they are not all created equal. Some platforms are more suitable for beginner traders, while others can be used by professionals. However, no matter which one you choose, it is important to do your research before making any decisions. You might consider opening a demo account if you are just starting to trade. You can then get to know the platform and ensure it suits your needs.

You might be asked to provide some personal information when opening your account for the first time. A redirection to the broker's web site might be possible. It's a good idea that you read the broker's trading terms before making your final decision. After you are confident in your decision, it's time to start trading.

Security is an important feature of a trading platform. The main advantage of the Metatrader is that it has a 128-bit security key, meaning that it is resistant to hacking attacks. It also offers many options for customizing the trading screen's appearance. MetaTrader icons can also be created by traders.

Many traders also find it useful to be able to mark up charts with trendlines or notes. These symbols are commonly required for technical analyses. These symbols can be used to highlight trade-relevant areas. There are many customization options. There are also two simulators you can use.

Although there are other platforms out there, the Metatrader is still considered the gold standard. Many Forex brokers support Metatrader. There are several reasons this is true. The most obvious is that MT4 is the most widely used Forex trading platform worldwide. Furthermore, there are hundreds of indicators and other trading tools available. It is also easy to tailor the platform to your specific needs.

Click the "download" button on your broker's website to start trading with MetaTrader. Most likely, your operating system will prompt you to allow the software download. After the software is downloaded, you will need to log in with your username or password. Accessing your trading account via tablet is easier if you're using a tablet.

FAQ

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Forex traders can make money

Yes, forex traders can make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

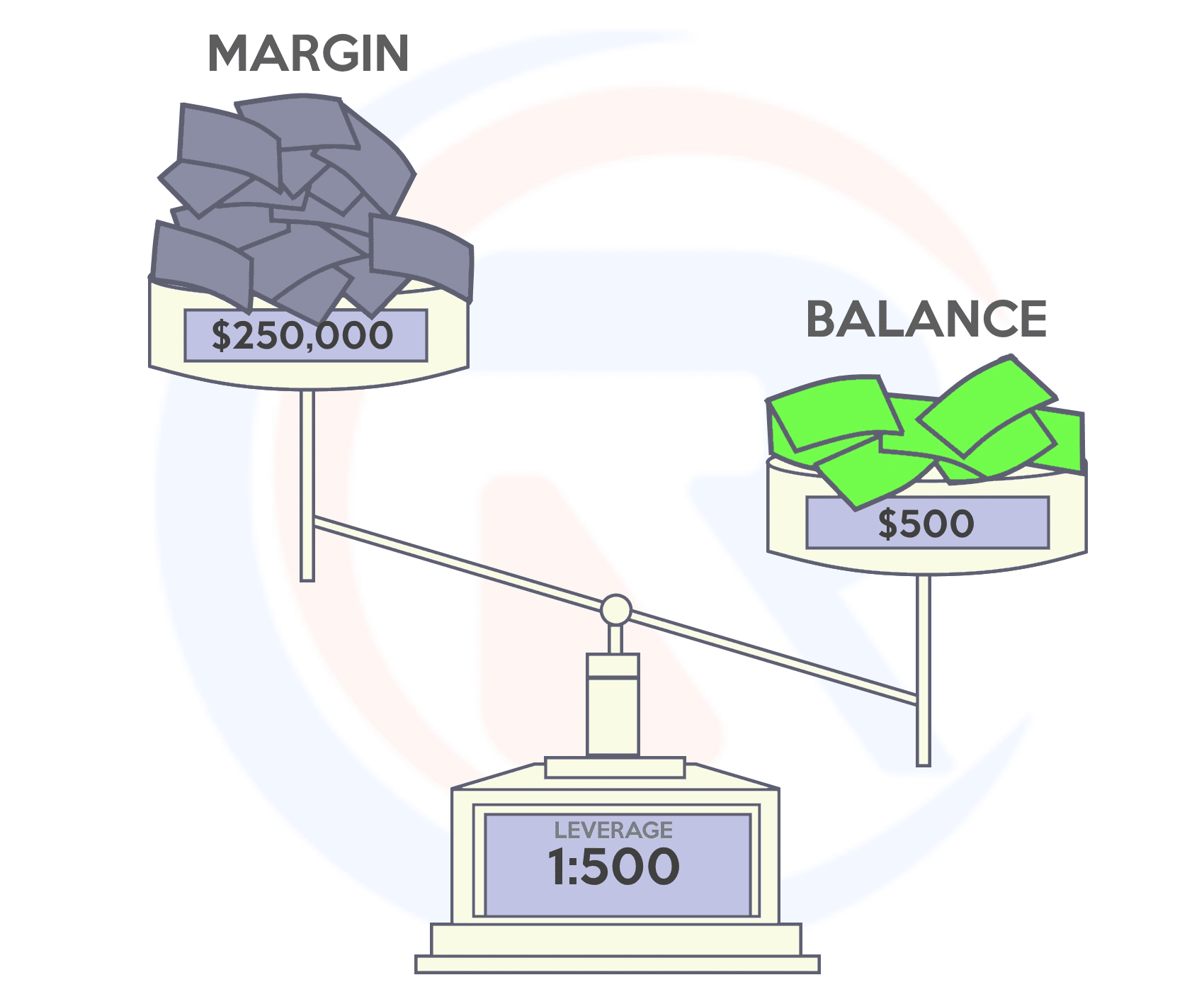

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

What are the advantages and disadvantages of online investing?

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. Some investments may also require a minimum investment or other restrictions.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

How can I invest bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need is the right knowledge and tools to get started.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

When investing online, security is crucial. Online investments can be dangerous. You need to know the risks and how to mitigate them.

You must be mindful of who your investment platform or app is dealing with. Reputable companies have good customer ratings and reviews. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. To ensure your account security, disable auto-login on all devices. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. You should also use different passwords to protect each account from being compromised. Last but not least, make sure to use VPNs when investing online. They're often free and easy!