You should expect volatility when investing in crypto. It is possible for a cryptocurrency's value to fluctuate rapidly within hours. If you don't prepare, your coins may not sell for profit. This could lead to a huge loss.

Before you invest in a cryptocurrency, you should make sure you have all your finances in order. Keep an emergency fund ready and have a diversified portfolio. Keep your credit score high. A drop of credit scores can cause severe damage.

You can earn a lot of money investing in cryptocurrencies, but it is extremely risky. To minimize this risk, you need to be educated. You should read articles and whitepapers on the topic. These will help you understand the investment case and the potential risks. Do your homework and make sure you read all the fine print before opening an account.

The lack of regulation is one of the greatest problems with crypto. Many cryptocurrencies can be backed by cash flow, or a hard asset. However, many others aren't. The crypto market is volatile and you should be prepared to suffer significant losses.

Understanding the tax implications for investing in crypto is crucial. For example, if you're a US resident, you'll pay capital gains tax on any profits from a crypto investment. But this is just one of the risks. There are many industry scams that can prove dangerous.

Security is another thing to think about before you make an investment. You should be cautious when investing in cryptocurrency exchanges. Although some exchanges provide secure storage, you should make sure to verify them before making a purchase.

There are other risks to consider, including privacy issues. Unlike stocks, cryptocurrencies cannot be regulated, so you'll need to protect your personal information. A hardware wallet is better because it's more secure. Keep up to date with developments in your cryptocurrency.

It is possible that you will fall short of your financial obligations. This could lead to repossession or even foreclosure, and will affect your credit score.

A new coin purchase can be a great opportunity. But don't overdo it. The impact of a 10% drop on the price of a coin is much greater than that of a 95% decrease. You might also not realize the potential for a huge return on your investment if you sell your coins early.

Investing in crypto can be a great way to diversify your investments, but it's not for everyone. Particularly if you don't know much about the industry, it is important to take your time to learn more. Find a reliable educational source.

After you have learned all you can about the industry you can begin to apply for a job. Make sure you do your research before you start to create a plan. Don't be afraid to talk to others, since they can give you an unbiased view of the market.

FAQ

Which is more difficult forex or crypto currency?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

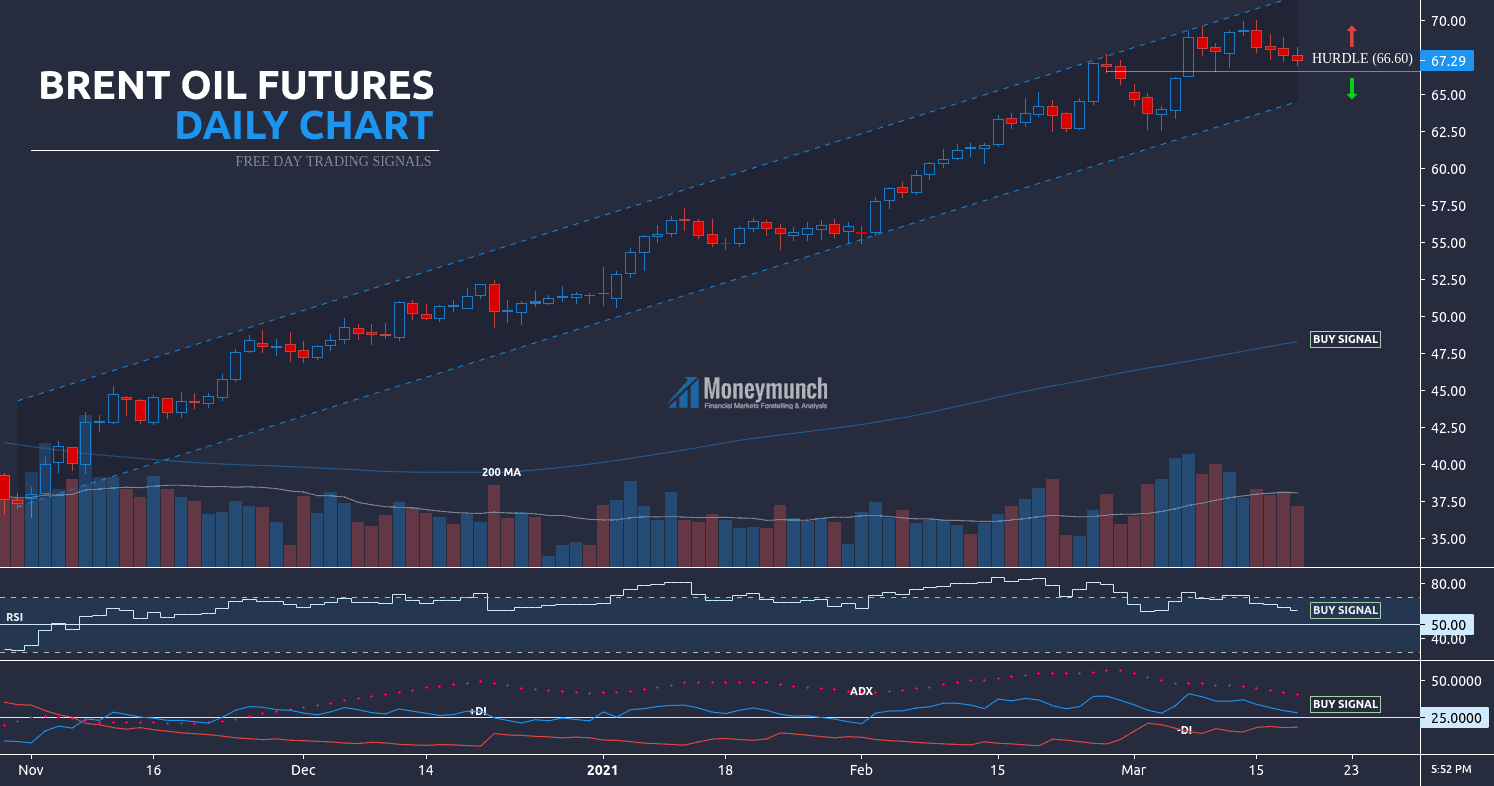

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

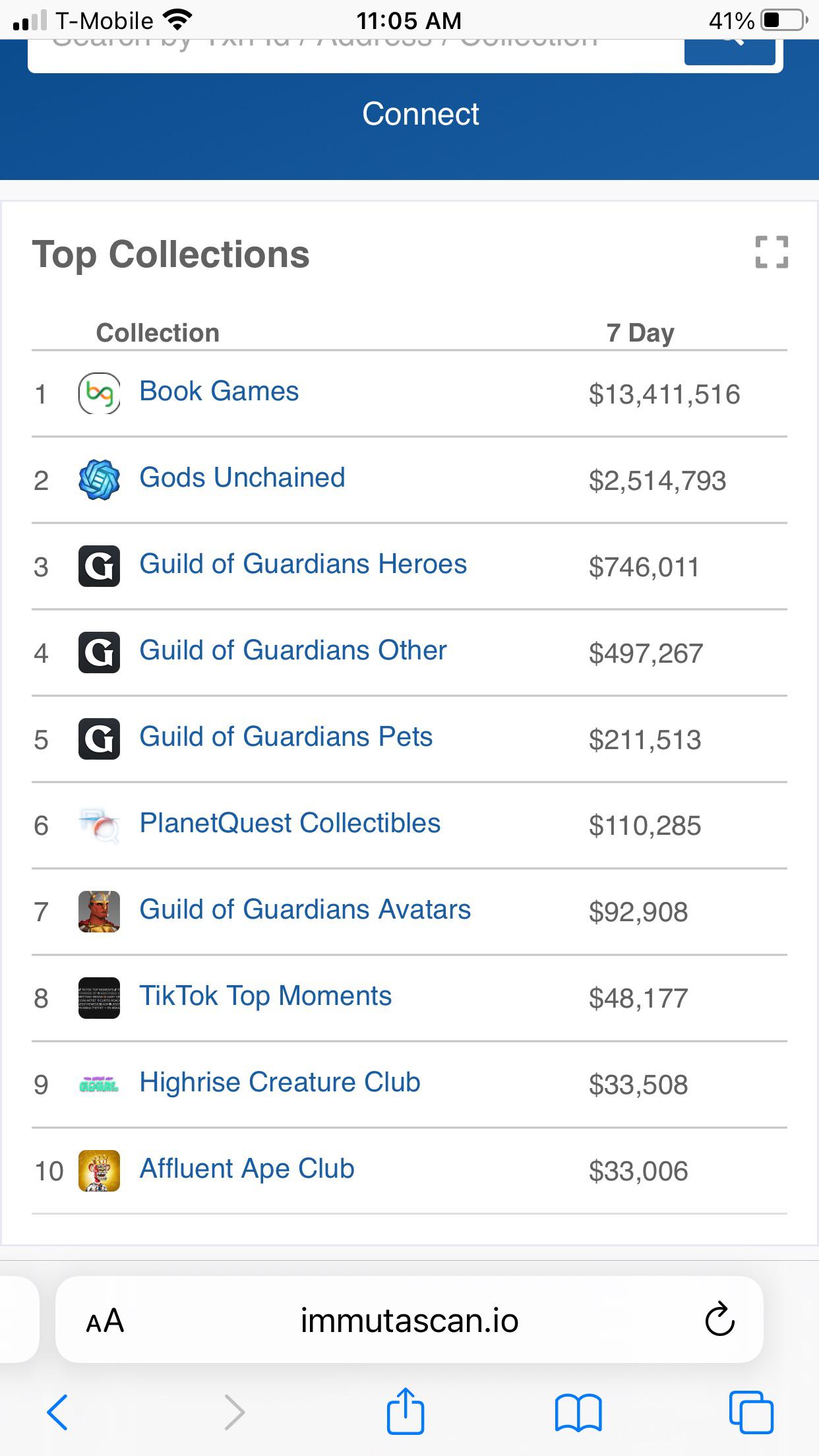

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which trading site is best suited for beginners?

Your level of experience with online trading will determine your ability to trade. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

How do forex traders make their money?

Forex traders can make a lot of money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are many options.

You can also invest in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Online investing requires research. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Conduct due diligence checks to make sure that you're receiving what you paid for. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.