Learn Stocks

The stock markets are a great place where you can invest your hard-earned capital. This can help you build wealth and increase your retirement savings. Before you start trading stocks, however, it is crucial to understand the market and your goals.

Investing and learning to trade stocks can be very addictive, so it is a good idea to start with a small amount of money and gradually build up your portfolio. This will allow you to learn how to cut losses and never risk more than you can afford to lose.

Understanding the Market

Reading as much information as possible is a great way to learn about the stock market. This includes reading articles, news stories, and even watching videos. This will enable you to understand the jargon and terms used in the market.

This will also help you make better investment decisions based on real-world information that is relevant to the company you are investing in. This could include information such as sales growth, profit margins, or the financial health of a company.

Understanding your goals

You don't have to decide if you invest in stocks just for the fun of it or for retirement. This will help you to determine which companies and industries are right for you, so you can be more successful when you begin trading.

Fundamental analysis refers to the process of analysing a company's financial performance and financial health in order predict future stock price movements. Earnings reports are a common tool for this purpose.

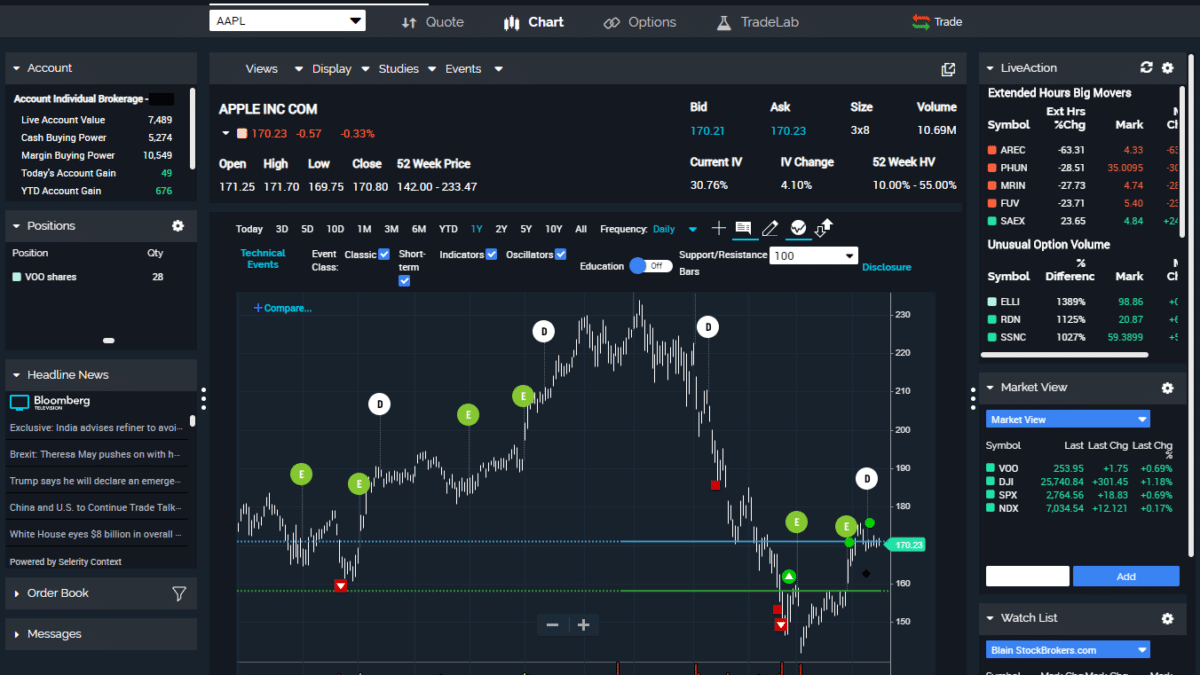

Candlesticks can be used by traders to track the stock's direction. Patterns are also important to traders, such as bullish homing patterns, evening star patterns and bear pennants. These patterns are a great indicator of where stocks are headed. It is crucial to be able to interpret them.

These patterns can all be found in any trade book. However, it is best that you study them in depth so that you are ready to trade when the time comes.

Selecting a stock you wish to invest

It is always a good idea to choose stocks that have had a good track record of success in the past. This will allow you to feel more confident in trading, and it will also make it easier for you to decide which stocks you want to buy.

Trade a wide range of stocks

It is a good idea to diversify your portfolio with various types of stocks. This will lower your risk and help you avoid being too invested in one industry or company.

You should also learn how to trade stock market using multiple strategies. This will help to make the trading process easier and create your own trading style.

FAQ

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Forex and Cryptocurrencies are great investments.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is more difficult, forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. A good understanding of technical indicators is essential to identify buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is the best trading platform?

Many traders find it difficult to choose the right trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

When investing online, security is crucial. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

It's important to be aware of who you are dealing directly with on any investment platform or app. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds to them or give out personal information, do your research.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!