Although cryptocurrency investing is a great way to make some money, it comes with many risks. Before you invest, it's important to understand the risks and know how to manage them. A diverse portfolio should include both traditional investments such as stocks and cryptocurrencies. This will help you build an investment portfolio that's well suited to your risk tolerance and financial goals.

Crypto Mining Investment

Bitcoin is the most well-known cryptocurrency, but there are thousands of others to choose from. It is best to invest in cryptocurrency by buying a few coins and then waiting for their price to rise over time. Although this strategy is most commonly used for crypto investing, it isn't always feasible or profitable. Many cryptocurrencies fluctuate in their value quickly.

Crypto is not backed by precious metals or governments, making it susceptible to price swings. James Putra (Senior Director of Product Strategy at TradeStation Crypto) says that crypto should be kept to between 2% and 5 percent of your total investments.

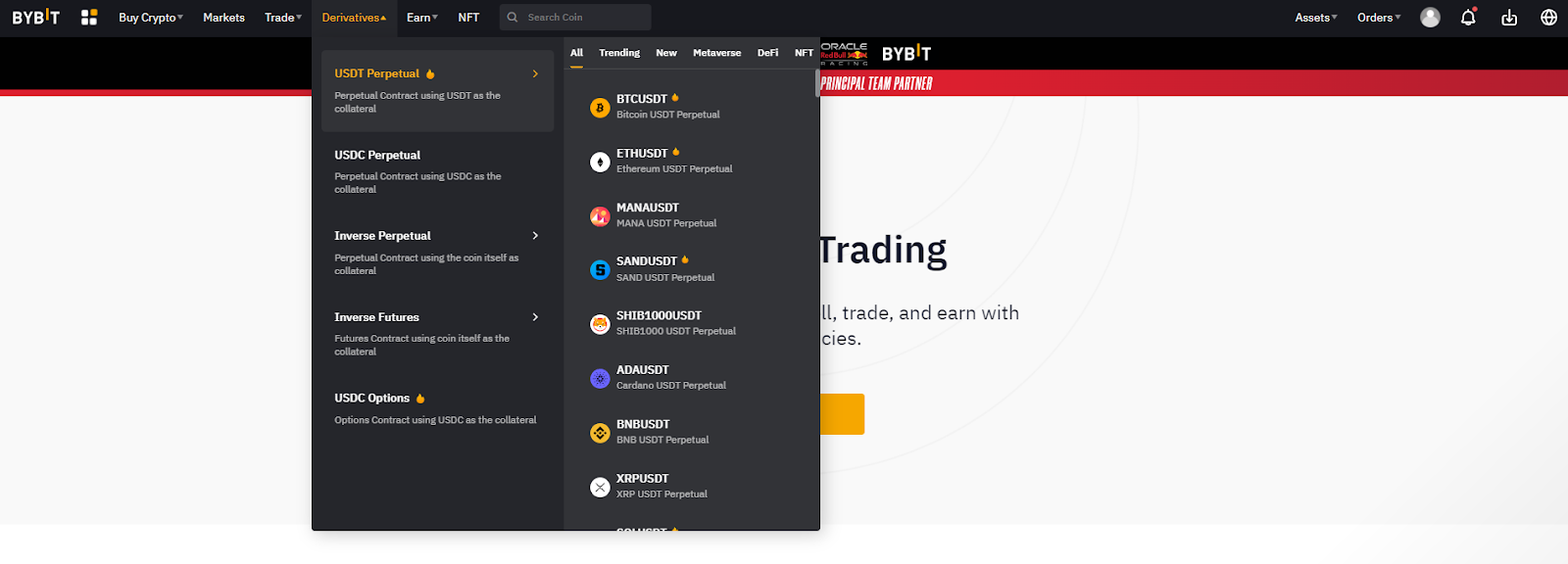

You can also hedge cryptocurrency or place bets against them by using futures and contracts for difference. These financial instruments allow you to speculate on the future price of a currency. This can be an effective way to diversify your investment portfolio, but it's still highly speculative and should only be done with the guidance of a financial professional.

Reddit Crypto Investing

Reddit's community is a great place for crypto investing discussions. Users can share and discuss the latest news within the cryptocurrency space. There are discussions about everything from the market's thoughts to the latest ICOs which are new cryptocurrency projects that sell tokens to investors.

This is an excellent place to look into a potential cryptocurrency project. You can also review the company’s mission, goals and vision.

Fight Out is transforming the play-to earn and fitness industry with its revolutionary new app. Currently, the FGHT token trades at more than $45 per coin. The company plans to offer a wide variety of seasonal tournaments with substantial prize pools.

Reddit is also worth checking out the Calvaria token. Its RIA token is at over 90% during its final stage. It has raised more $2.8million already, and if it gets listed on an Exchange it will be an excellent choice for anyone who wants an investment in a decentralized network of gaming.

The MEMAG token could be a good option for anyone who loves meme coins or P2E. It is currently in beta testing for games that give a nod to the arcades from the past.

Do your research before investing in crypto. The main thing is to verify that the token you are purchasing is legitimate. If you find any scams, contact the company immediately.

FAQ

Where can I invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are many options.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which trading site is best for beginners?

It all depends on your level of comfort with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which is harder forex or crypto?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts should be safe. It's vital that you protect your data, assets and information from unwelcome intrusion.

You want to ensure that the platform you use is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. Also, a policy should be created that describes how the sharing of personal information with them will go.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Check your account activities regularly to be alert of any unusual activity.

Third, you need to know the terms of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, make sure you do thorough research about the company before investing. Review and rate the platform and see what other users think. Finally, be sure to know about any tax implications that investing online can have.

These steps will ensure your online investment account is protected against any possible threats.