Online stock trading accounts are one way you can invest. You can choose among a variety of companies and some of the top investing platforms can help you trade stocks overseas. But before you jump into the fray, you should be aware of the perks and pitfalls of the industry. Here's a guide to the main factors you should consider.

One of the most important aspects of investing is finding the right broker. This can be a daunting task, especially when there are so many different options out there. Many brokers offer free demo accounts so you can check out the features and decide what suits you best. You should know that not all brokers offer this service for free. Please read the fine print.

You should also consider the company's customer support. A good reputation is essential if you are an active trader. A reliable and responsive service will make your life easier, and your experience will be a whole lot less stressful.

The trading strategy is another important aspect. You might want to choose a handful of companies if you are looking to buy stocks and keep them as long as you can. The same goes for selling them. A broker can provide a variety tools and services that will allow you to get the most from your investments.

Another thing to think about is your level of experience. Some brokers are geared towards the casual investor, while others are built for the seasoned trader. The differences between these types brokerages can make a big difference in your investment decision.

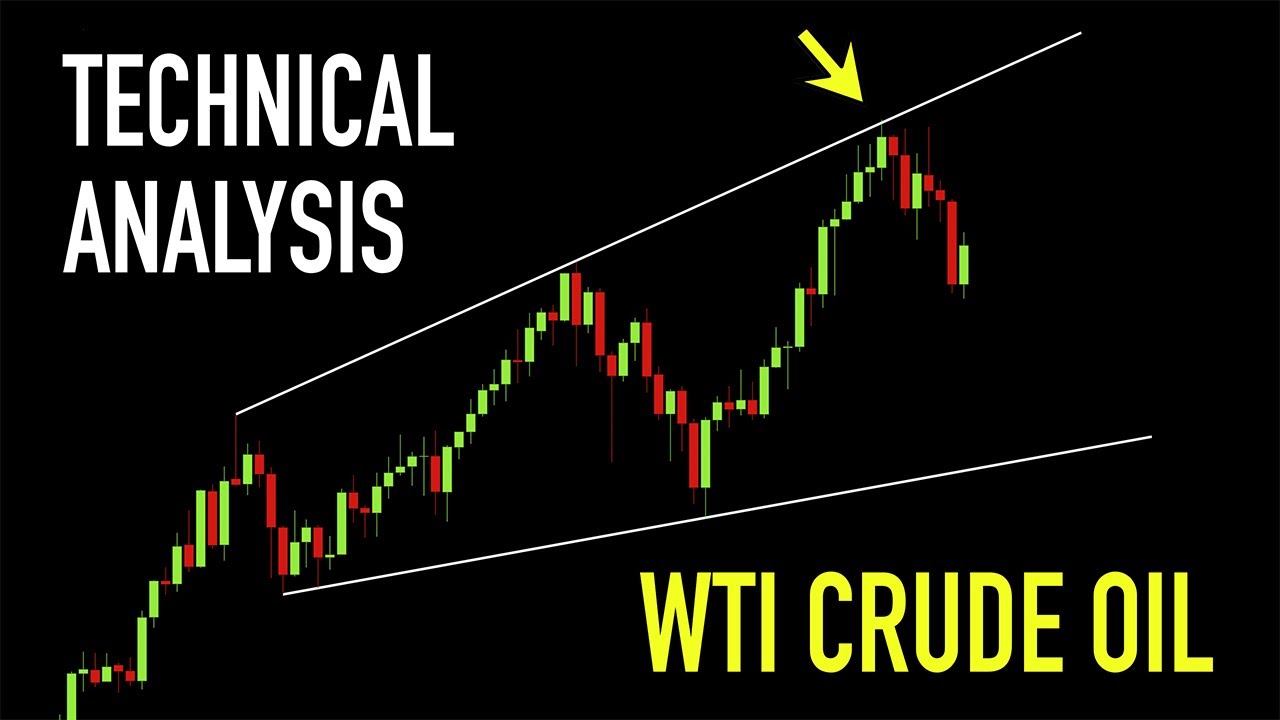

You can also take advantage of the most recent technologies such as virtual reality and mobile apps through the best investment platforms. They'll also let you access research reports, such as analyst ratings and technical analyses. These tools are helpful when you want to evaluate the health and performance of the stock market.

The final step is to select the right platform that suits your trading needs. There are a variety of options, from full-service brokers to discount stock brokers. Some companies charge a small deposit, while others require you open an account with a larger deposit. Select the broker that offers the best price.

An online stock trading account is an excellent way to get started investing. It is one of most used financial products. You can find companies that cater both to the beginner and the experienced trader. You can start your journey to a rewarding, fulfilling career in investing by looking at the different options.

An online stock trading account isn't as complicated as you might think. A few basic details and an account number will be required.

FAQ

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. It can be confusing to choose the right one, with so many options.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the pros and cons of investing online?

Online investing is convenient. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection starts with yourself. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Never respond to unsolicited phone calls or emails. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before making any commitments, thoroughly research investment opportunities independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Don't forget to remember that "Scammers will attempt anything to get personal information." Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It is also important that you use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.