Forex trading hours are the periods of time when the major foreign exchange markets are open for trading. These markets provide currency exchanges necessary for international trade, central banking and global business.

Forex market offers different session types, each having its own open/close times. There are also markets that overlap at different times of the day. These overlaps can often be advantageous to speculators because they allow them to have more liquidity in particular currencies.

Traders may also find that specific times of the day are better for trading than others. Forex traders will often trade in the currency pairs with the highest volume trading. This allows traders to have greater leverage and has narrower spreads.

London/New York Sessions Overlap

At a critical point in the trading day, New York Forex sessions overlap. Here is where most of the forex market's volume is traded. This is a crucial part of the day's trading, accounting for most of the daily change in value. There are trillions of dollars being traded during this period.

It is also during these hours the Reuters/WWM reference spot rate is established, which serves as the basis to many price quotations. This rate is based upon the ten largest currencies. It is used to determine daily pricing and valuations for many money managers as well as pension funds.

European Session - Overlap

At this stage of the day, the EUR/USD/USD, GBP/USD or USDJPY market are the most liquid, as most currency pairs are actively traded. These markets are lively for a variety of reasons. There is a lot of trading taking place here, and there is more volatility than at other times.

Tokyo/Singapore Überlappung

The markets in Tokyo, Singapore and Hong Kong also overlap for a short period of time at this point. The Tokyo market opens from 1:00 to 3:00 AM. Singapore and Hong Kong markets open until 5:00 PM.

This overlap is an important forex trading time, especially for traders who trade in EUR/USD/USD, EUR/JPY or GBP/USD currency pair. Speculators can earn more by trading with higher volumes and smaller spreads.

These times are especially profitable for day traders or scalpers who trade large volumes of currency pairs. This also allows speculators a chance to maximize their profit by being able open and close positions whenever they wish.

Sydney/Sunday - Overlap

The Sydney forex markets open every weekday in Australia at 5:05 PM UK time. However, some traders open their rates an hour earlier. The Sydney Forex Market then closes on Sunday at noon UK time, closing the 24-hour Forex loop.

Forex trading hours may seem complicated. It can be hard for traders to identify the best times to trade. It all depends on you trading style, lifestyle, preferences, and the currency pairs that interest you.

FAQ

What are the disadvantages and advantages of online investing?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

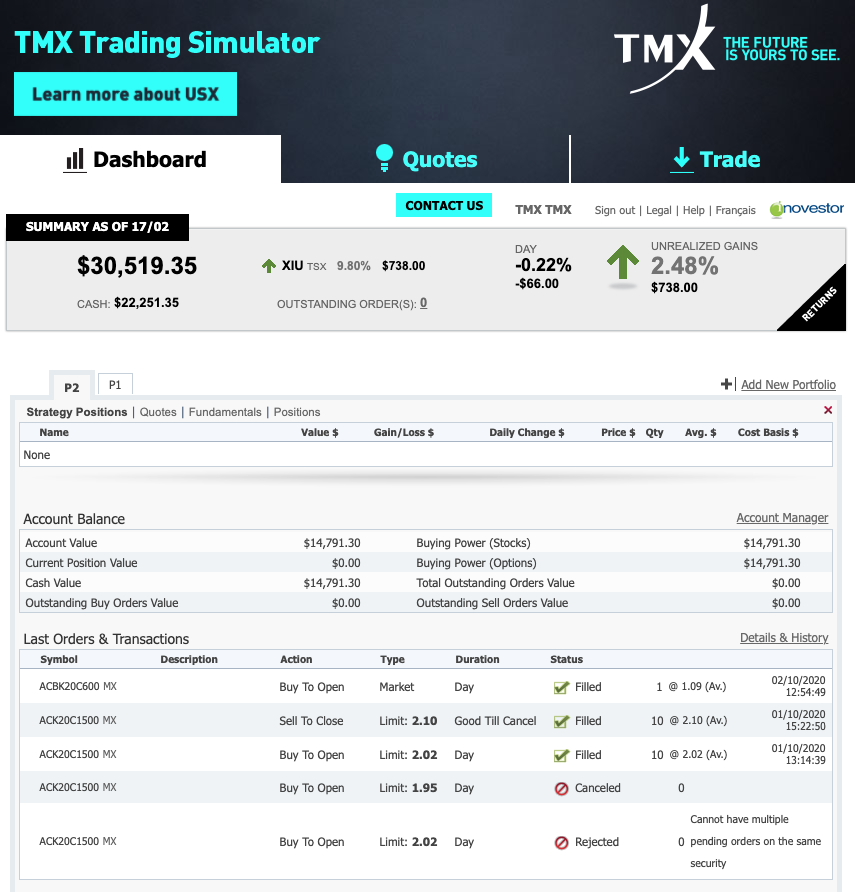

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is safer, cryptography or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Which is best forex trading or crypto trading?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

It is important to research both sides of the coin before you make any investment. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

When you invest online, it is crucial to do your homework. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.