Forex market trading allows you to buy and sell currencies online. This is a different type of investing than traditional ones like stocks, bonds or real estate. The currencies are subject to fluctuation and traders may lose their money.

Foreign exchange trading, which has a daily turnover in excess of $3 trillion, is the world's largest and best-liquid market. It is open 24 hours a day, five days a week with trading centers in major global financial locations including London, New York, Sydney, Tokyo and Hong Kong.

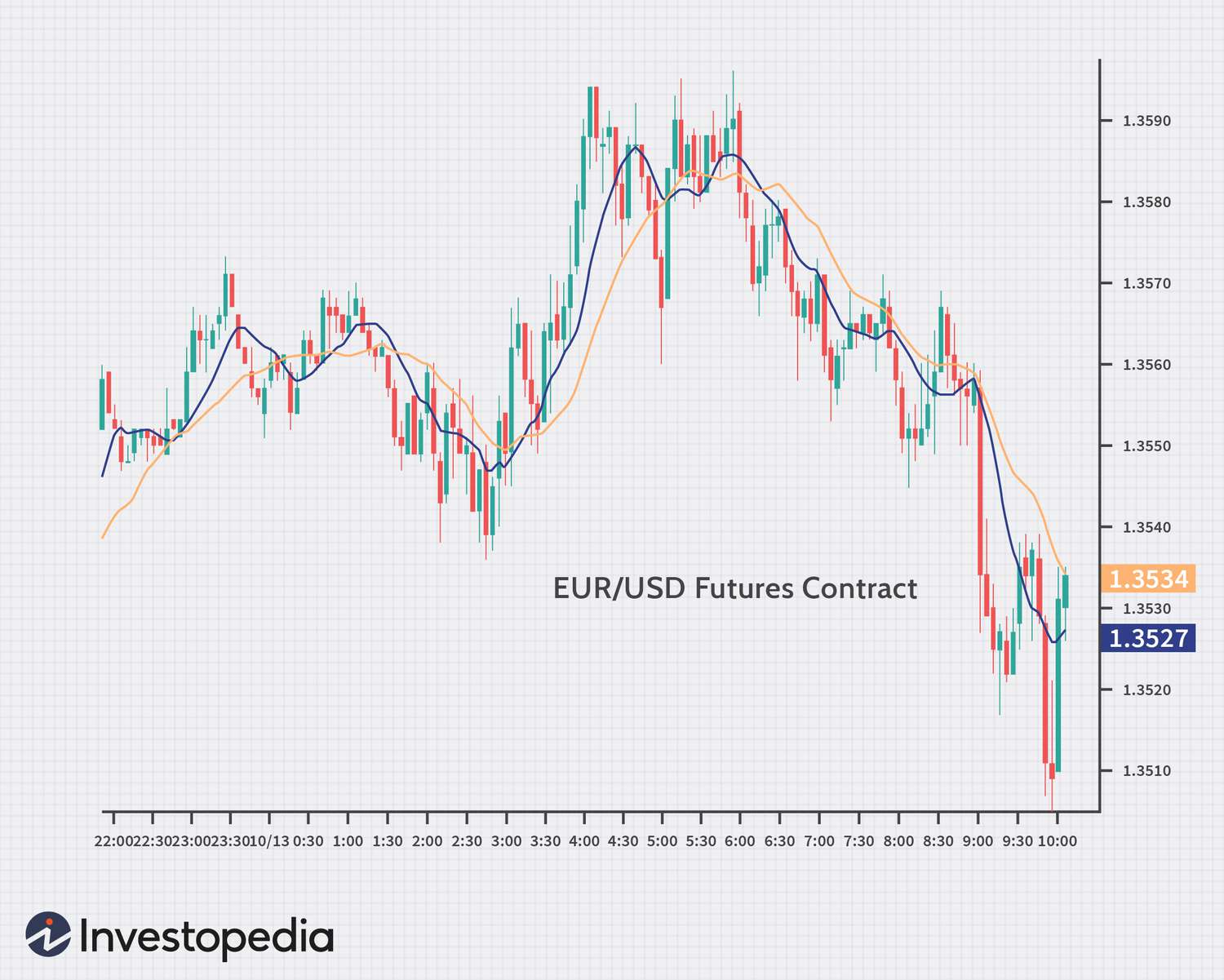

Forex pairs are the most used type of trade. Currency pairs involve two currencies being traded together to determine the relative value. The most well-known pair on the market is the Euro/USD (EUR/USD).

The Forex market is a global decentralized marketplace where buyers and sellers trade currencies. There is no central currency market, and all trading takes place electronically by way of a broker.

Fundamental Analysis

News and events that have an impact on a country's currency or economy can influence currency markets. This includes changes to interest rates, inflation or trade flows. You can also influence it by the actions and policies of large players like government agencies or multinational corporations.

Technical Analysis

Forex traders often use technical analysis to help them make their trading decisions. This involves looking at price charts and chart patterns to determine price movements. This can be a great strategy for forex day traders who want maximum profits by placing trades at the right times.

Forex market volatility

It is the volatility in forex markets that will determine a trader’s success or failure. It is the amount of change in a currency pair's value, and experienced traders will take advantage of this by placing their trades when prices are moving quickly.

Spoofing/Ghosting

This is when traders and brokers attempt to lure traders into placing large orders. They won't. This can be a form of manipulation, and it is important to check with your broker or research the broker before opening an account.

Leverage

Leverage, a trading tool that lets you trade larger amounts than your capital, can increase your profits and decrease your losses. This is a great way of trading but it should be used with caution, as it can add another layer of risk.

Scalp trading

Another form of forex trading is scalping. In this type of trade, traders attempt to gain large profits in a very short time. If the market is volatile and you have a reliable forex broker who supports scalping, this strategy can work well.

In recent years, the forex market is a booming business as more people realize its potential to make high-profit trading currencies. You can choose from many types of forex trading to meet your investment goals and budget. You must ensure that the forex broker you choose has a broad range of options, and offers support to your specific needs.

FAQ

What is the best trading platform for you?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

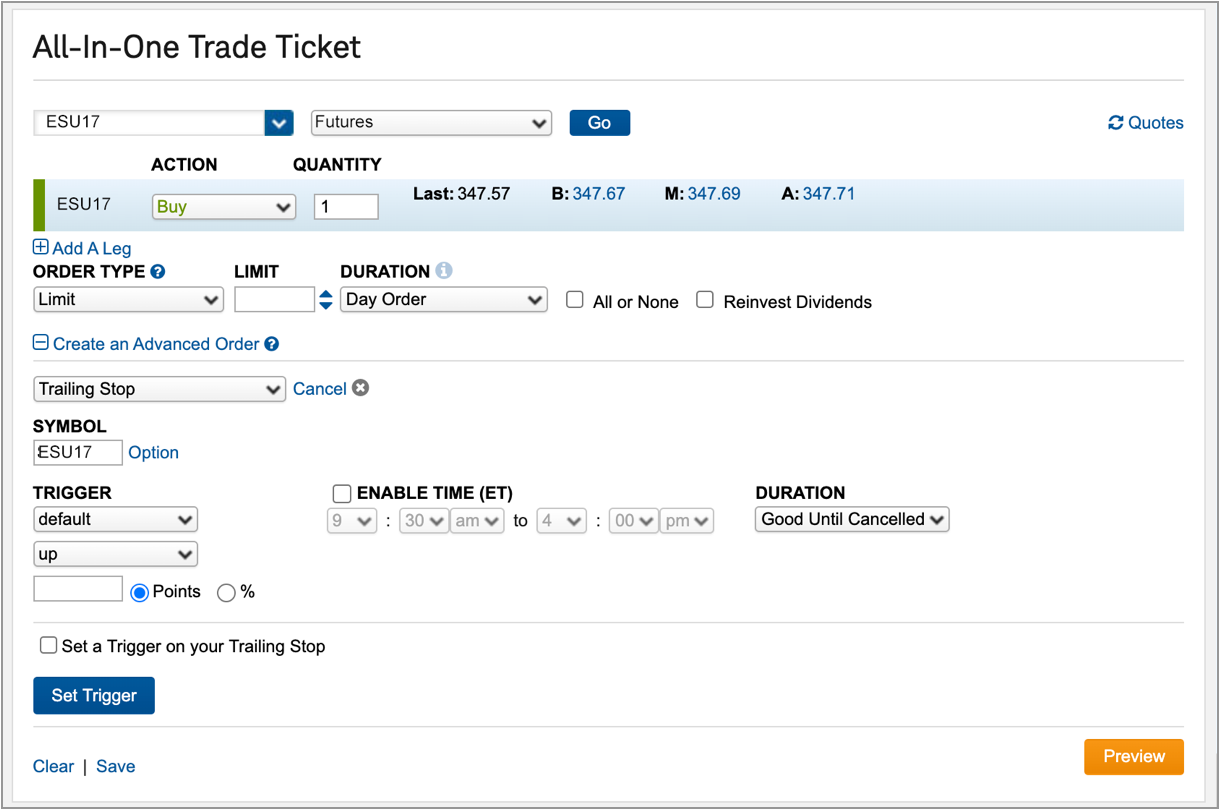

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

What are the pros and cons of investing online?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Frequently Asked Question

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Where can I invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are many options.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. Trading with money you can afford is a good way to reduce your risk.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Online investing requires research. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.