Check the security of your trading site before you trade NFTs. This is especially important if you are looking to purchase collectibles. A reputable company will provide a secure, reliable, and high-quality NFT. Scammers can target even the most reputable NFT trading websites.

One of the most important ways to keep your NFTs secure is by storing them in a private crypto wallet. You can also store your tokens on a physical device like Ledger. That way, you can have the security of knowing that they are kept off of a public marketplace.

Another option is to buy NFTs via a curated market. These marketplaces will prescreen artists and projects. Many of these websites include a community of artists and traders. You can buy and sell NFTs. Additionally, you can also support one another's work and collaborate on projects.

SuperRare or Rarible are some examples of NFT marketplaces that have been curated. Both offer a wide variety of high-quality digital collectibles. These stores allow you to search through thousands of NFTs to find what you are looking for. While they charge a small fee, they aren't as well known as some of the other curated stores.

Some NFT markets require that you create a profile and provide KYC information in order to make purchases. This could be a red alert for some users. You might need to place a bid if you want to purchase an NFT from a celebrity. NFT sites usually allow buyers and sellers to accept bids, but it's possible to also list a collectible with a fixed price.

The NFT market is growing in popularity. NFT trading platforms are being developed by some of the most prominent companies in the central crypto trading industry. Binance is one the most prominent names in crypto trading and has a large market for NFTs. GameStop is another company that is interested in the NFT industry.

You can also search NFT traits by fashion or sports memorabilia. You can filter NFTs by style or gold fur on some sites. Additionally, some NFT marketplaces will let you buy NFTs using your credit card or Apple Pay.

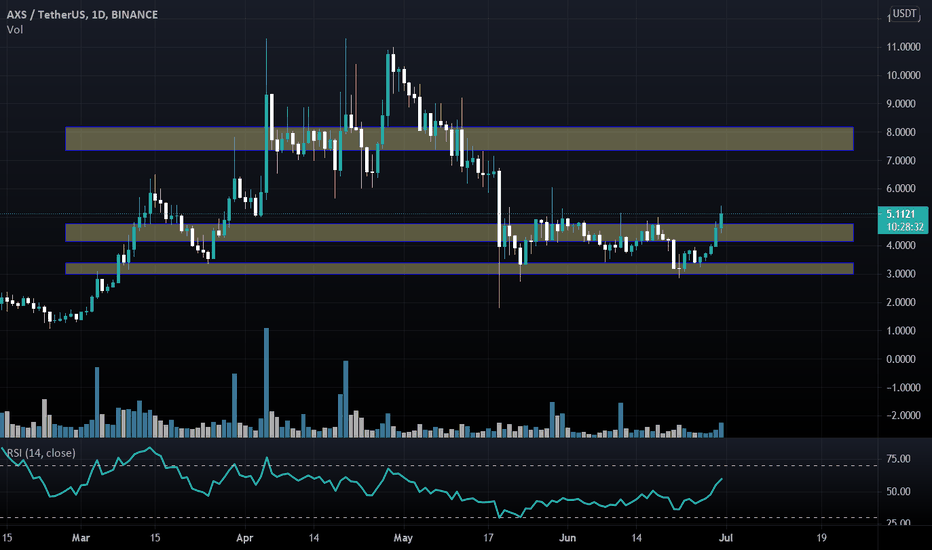

You should also consider the trading volume of your trading platform. A high trading volume is a sign that there are many people selling and buying on the site. The site may not be as active if it has a low trading volume. In order to visualize the trading volume in graph form, it is a good idea. It is also an indicator of a site's reputation that its daily trading volume.

It's also important to think about how simple it is to use. NFT sites often require customers to register KYC details and connect their cryptocurrency wallets. In addition, most of these sites ask for customer service contact details. If you have problems with your account, contact customer support.

FAQ

Is Cryptocurrency Good for Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also feature an intuitive, user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important to understand the different types of investments available when considering online investing. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Where can I invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

How do forex traders make their money?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts are a matter of safety. It's essential to protect your data and assets from any unwanted intrusion.

First, ensure the platform you are using is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Review and rate the platform and see what other users think. Finally, be sure to know about any tax implications that investing online can have.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.