For beginners, the stock market can seem intimidating. There are thousands of stocks available and there is no one strategy that will work every time. It can be difficult to decide which stocks to invest in. These tips can make it easier.

Best Dividend-paying Beginner Stocks

If you're a beginner stock investor, you should start by building a diversified portfolio of low-cost index funds. These low-cost investments often outperform both active fund managers as well as stock pickers. This can make investing exciting and rewarding.

However, you need to find a trusted broker who can assist you with managing your trades. There are many choices, from free apps for trading to high-fee brokerages. These will help you to navigate the stock investment process.

Choose the right app for trading your stock shares

Investment apps have become easier to use in the past decade. Whether you want to invest in stocks, ETFs, or options, these apps have made it easier than ever before to trade from the comfort of your smartphone.

These apps allow you to save money by not having to pay fees. They also make it easier for you trade. Many of these apps have low or no account minimums, so you can easily get started with just a few dollars.

The Stocks You Must Buy and Hold

It's important to choose a few well-respected companies for their stability if you are just getting started in the stock market. These blue-chip stocks are likely to provide consistent returns, offer dividends and have a low risk factor.

Microsoft, for example, is the world's largest technology company and reports the highest-ranking revenues and returns to investors. It also pays a dividend for shareholders and continues innovation, leading this industry.

Apple is another top tech company I recommend to beginners. It is well-known for its innovative products, loyal fan base and other great features. Apple is still a dominant player in the tech sector, despite recent market volatility and regulatory issues.

Finally, Disney is one the most famous companies in the world. It has a long history in entertainment and media business success. Its animated cartoons, as well as its iconic films, are popular all over the world and enjoyed by people of all ages.

You can become a successful investor by sticking to a simple plan. You can make your savings grow while you work towards your goals.

Before you buy stocks, you need to know your risk tolerance and investing style. This will help to decide the stocks you want to add to your portfolio. It will also ensure that your potential return is maximized.

FAQ

Which trading website is best for beginners

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many offer interactive tools to help you understand how trades work.

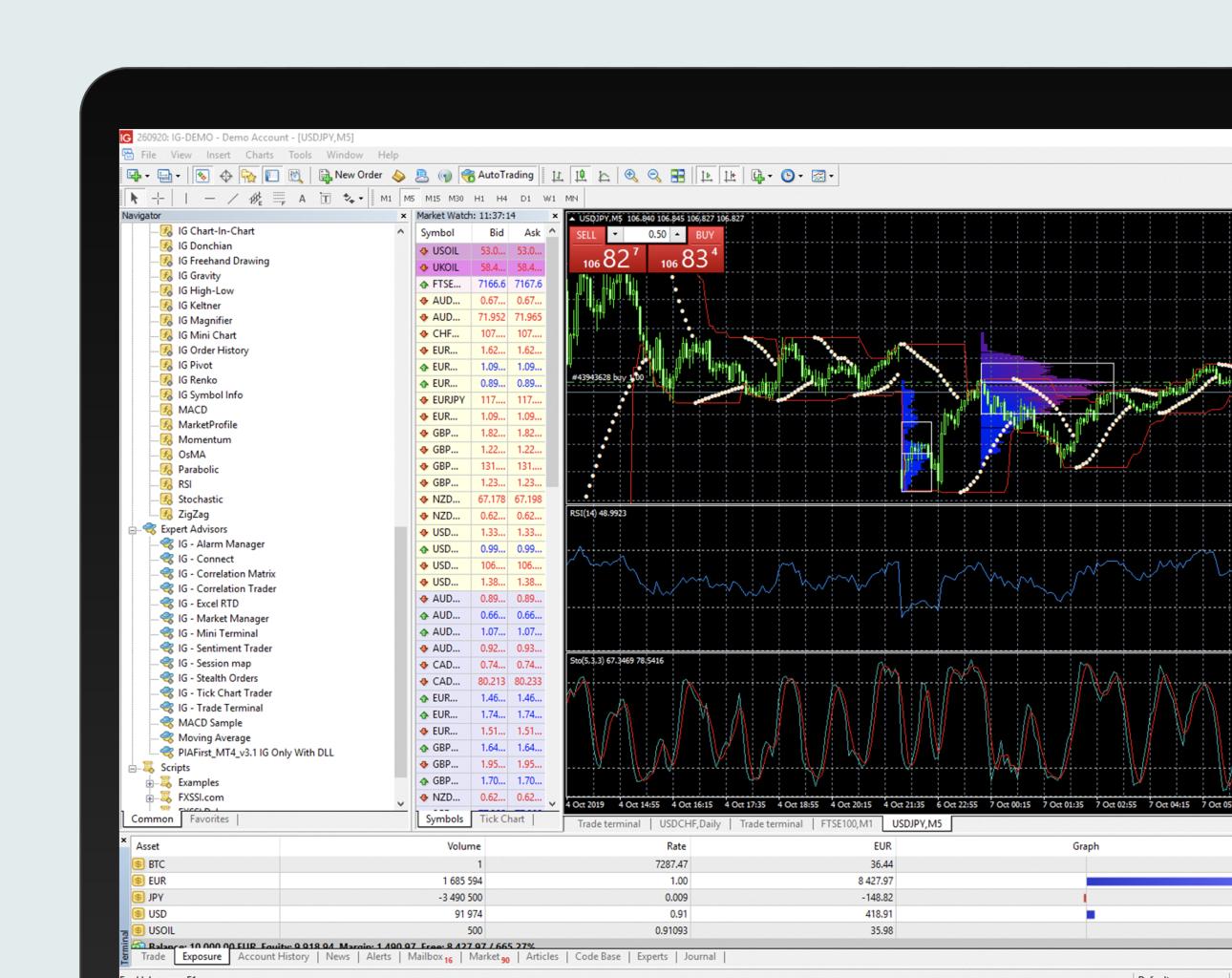

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases, it's important to do your research before making any investments. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Frequently Asked Questions

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Understanding the different currency conditions is crucial.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Online investments require security. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Be mindful of whom you are dealing with when using any investment app. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds to them or give out personal information, do your research.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Finally, invest online using VPNs whenever possible. They are usually free and simple to set up.