Trading the UK's markets requires a trusted and reliable platform. It is important that you choose a broker who will manage your investments safely and securely while also offering great customer service should you have any problems.

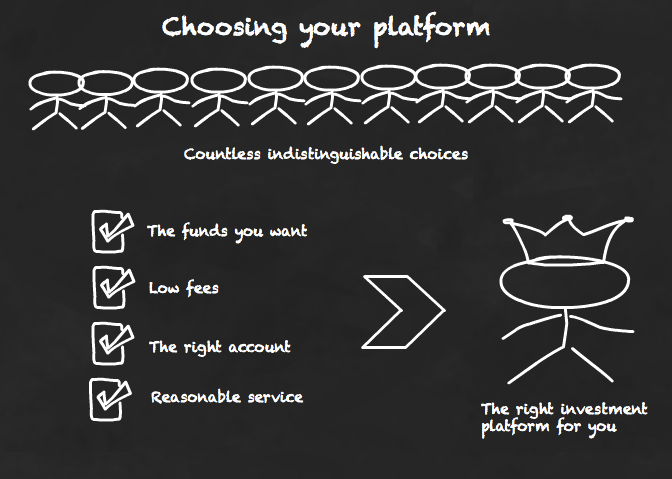

There are many UK trading platforms available, so it is worth researching before you choose the right one. Before you decide which one is best for you, there are some things to keep in mind.

Best Trading App Uk

A platform that is user-friendly and offers low fees is essential if you are looking to invest in the UK stock markets. You'll also want to make sure that you can access your account from anywhere in the world, as this will be essential if you're travelling for work or holidays.

eToro

eToro is a great choice if you are looking to trade the UK markets. It is simple to use and offers many features that make it a great trading app.

It's available on both iOS and Android. Sign up is completely free. Plus, eToro allows you to deposit funds using credit/debit cards or e-wallets.

IG

IG is a great option for traders who are moderately active. They offer low share trading fees and a robust share charting package. Its charting software is particularly useful for technical analysis and is available in 22 languages. This makes it an excellent choice, and is especially popular with investors who trade currencies.

Pepperstone

Pepperstone offers many products and a great stock-dealing service in the UK. These include forex, options trading, and crypto trading, as well as unique currency indices. Its MT4 platform supports a variety of third-party social copy-trading apps and research tools.

Skilling

As one of the most popular uk trading platforms, Skilling is a great choice for beginners who are looking to learn how to trade stocks. It offers many educational resources and shows you how to control your risk by setting stop loss. It also provides 1000+ trading strategies that you can copy to maximize your profits.

CMC Markets

CMC Markets, a reliable and trustworthy online broker in the UK is what you should be looking for. CMC Markets has been in operation since 1989 and is a leading player in the market. The Financial Conduct Authority (FCA), regulates UK-based operations. The trading platform it uses is simple and intuitive.

Interactive Brokers

This broker is an excellent choice for traders looking to trade stocks and currencies in the UK. Its UK-based operations can be regulated and authorized by the Financial Conduct Authority (FCA), and offer excellent deposit and withdrawal options.

Interactive Brokers can also offer SIPP and ISA accounts. This will help you save even further on your trading costs. The broker is also a great choice for investors who want to access the US market.

FAQ

Do forex traders make money?

Forex traders can make good money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which platform is the best for trading?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

How can I invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. To get started, you only need to have the right knowledge and tools.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, gather any additional information to help you feel confident about your investment decision. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts should be safe. It's essential to protect your data and assets from any unwanted intrusion.

You want to ensure that the platform you use is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Check your account activities regularly to be alert of any unusual activity.

It is important to be familiar with the terms and conditions of any online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. You should also be aware of the tax implications when investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.