There are many options for opening an account online with a brokerage company. You should determine what type of investment you are looking to make and then choose a broker that will provide you with the features and services you need.

For example, if you plan to invest in gold or real estate, you might want a brokerage that provides access to both markets. The best brokers will provide a range of in-house earnings projections, research reports, and other services. Many will offer many other services, including trading platforms and mobile applications. Your requirements for funding an account will vary between brokers.

Lastly, you should look at your budget. A low-fee account is a good option for those with a smaller amount to invest. If offered, you may also be interested to receive a cash bonus. Cash bonuses can vary in terms of how long the clawback period is and how much it costs. They are offered by some robot-advisors.

You have two options when it comes to selecting a broker: you can either choose a traditional bank institution or an online stock brokerage. No matter what option you choose you need to be aware of the commissions for each trade. While you might pay less in fees for an online broker, you may not get the same type of customer service or other features. Online brokers may not offer discounts on mutual funds, or other investment vehicles.

When choosing a broker, another factor to consider is how easy it will be to open an account. While you may need to deposit at minimum $1 to open an Account, requirements vary from brokerage to brokerage. Some popular options do not require any deposit.

TradeKing is the most well-known option, with both free and paid trading. Other top options include Charles Schwab, Fidelity Investments, and Merrill Edge. These brokers are known as experts in their fields and are among the top brokerage accounts.

Consider how often you intend to trade as you start your search for the best brokerage account. If you are an active trader, you might prefer an account with lower commissions. You might also consider a account with a lower minimum investment if you are only looking to invest a few bucks each month.

If you have a large bankroll and are looking to save money, you can also look for brokers that offer a variety of bonuses and cash incentives. There are some brokers that offer a few free trades each month, while others might give you a hefty bonus for making a series of trades.

Finally, if your goal is to maximize the high rates offered by robo–advisors, you can look at a variety of robo–advisors and decide which one suits you best. Some robo-advisors, such as Betterment and Wealthfront, offer higher rates on cash balances, whereas other robo-advisors do not. This is a great benefit for people who want to minimize their fees while maximising their return on investments.

FAQ

What are the pros and cons of investing online?

Online investing is convenient. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing has its limitations. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Is it possible to make a lot of money trading forex and cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is better, safe crypto or Forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Can forex traders make any money?

Yes, forex traders are able to make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which forex or crypto trading strategy is best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

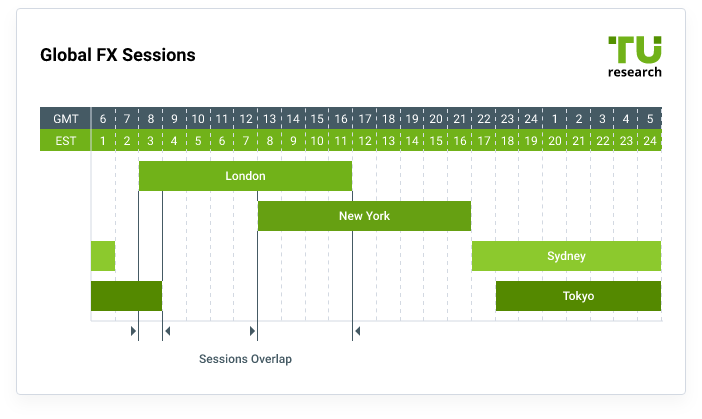

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

The decision about where to store your money can be complicated. Your valuable assets require a strong security system and you have a few options.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?