Beginners can find it intimidating to invest in the stock market. With thousands of stocks to choose from and no single strategy or approach that works all the time, it can be hard to know which ones to invest in. These tips can make it easier.

Best Dividend-paying Beginner Stocks

If you're a beginner stock investor, you should start by building a diversified portfolio of low-cost index funds. These low-cost investments can often outperform active fund managers or stock pickers, which can make investing exciting and rewarding.

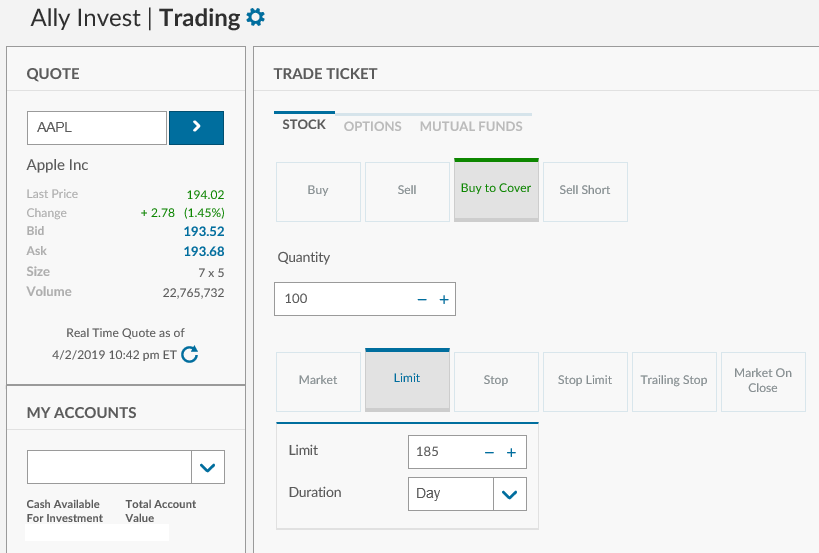

But, it's still important to find a broker that can help manage your trades. There are many options for stock investing, including free or high-fee brokerages.

How to Choose the Best App to Trade Your Stocks

Investment apps have become much more accessible over the past decade. These apps allow you to trade your stock, ETF, or other investments from your smartphone.

Using these apps can save you money by avoiding fees, while also making it much easier to trade. You can get started quickly with these apps by spending just a few dollars.

What Stocks Should You Buy?

If you're new to the stock markets, it's crucial that you choose companies that are known for their stability. These blue-chip stocks will likely provide steady returns, pay dividends, and have low risk.

Microsoft is an example of a large technology company. It reports consistently top-ranking numbers in revenue and returns for its investors. It also pays dividends to shareholders and continues its innovation, leading the industry.

Apple, a top tech company, is also a great choice for beginners. I love Apple's innovative products and loyal customer base. Apple continues to be a strong player in the tech market despite the volatility of the markets and regulatory issues.

Finally, Disney is the most popular company in the world. It has a long tradition of success in both entertainment and media. Its classic cartoons and films have a worldwide appeal and are enjoyed by all ages.

You can become a successful investor by sticking to a simple plan. It can also be a great way to make your savings grow as you work towards your goals.

Before you buy stocks, you need to know your risk tolerance and investing style. This will help you decide which stocks to add and optimize your potential return.

FAQ

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

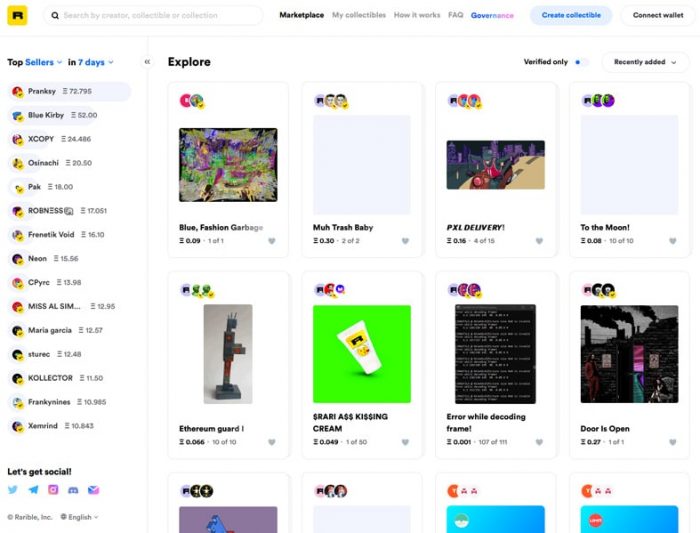

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

What are the benefits and drawbacks of investing online?

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing is not without its challenges. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is better forex trading or crypto trading.

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it's important to understand both the risks and the benefits.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

It is easy to lose your money, but it can also be difficult to decide where to keep it. You have several options when it comes to protecting your valuable assets.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?