Axie Infinity is an emerging crypto game which has made its presence known in the past few months. The game is based on Ethereum and uses a Ronin Ethereum sidechain. It also features a non-fungible token (NFT), called Smooth Love Potion. This is not a fully-featured crypto game but it does have its own trading and staking systems, and an extensive ecosystem. This is one the most innovative new players in crypto gaming, and the potential for growth is incredible.

Smooth Love Potion and the Axie Incentive shards are the currencies used in the game. But they aren't the only cryptocurrency that circulates. Small Love Potion (Non-fungible Token) is another feature of the game. These tokens are used as a reward for players who achieve certain level-related achievements. These aren't directly related to the Axie Infinity Shards price, but they can be a great way for players to earn currency.

Axie Infinity was founded in late 2017 by Aleksander Larsen, a Norwegian hacker and game enthusiast. His previous experience as a programmer with the Norwegian Government Security Organization was also a part of Lozi and Sky Mavis. With more than 1 million active users, the game is gaining momentum. The game's biggest selling point is its ability to earn passive income while playing a game. The game's monthly monetary rewards are currently at more than a million dollars.

A variety of technologies and features are available in the Axie Infinity game, which includes an XP hub and automated orders. There is also a token staking and a mating hub. Participating in the game's ecosystem through a variety of payment methods will give you the best chance to win. Besides a wallet, you can also use PayPal, Visa, or MasterCard. To store your coin, you can also use a digital wallet called MetaMask.

Axie Infinity is not the only crypto game on the block, but it's certainly the most innovative one so far. CryptoKitties is War Riders and Chainmonsters are some other notable crypto games. Some of these games are browser based, while others are mobile. All of these games are worth looking at, but Axie Infinity's patented Ronin Ethereum sidechain, as well as its native token, Smooth Love Potion is the best.

The AxieInfinity game is only part of a larger ecosystem that also includes an NFT-based trading and staking system. Axie Infinity has an interactive website that allows users to view game stats and other features. However, this website is purely for fun as Axie Infinity's actual game is currently in beta. This game will be available sometime this year. Axie Infinity can be enjoyed by anyone who is interested, whether they are playing the game, or purchasing or staking the tokens. A good crypto wallet will allow you to make the most Axie Infinity coins. Ledger is a popular choice, but you can opt for Trezor, as well.

FAQ

Which is better forex trading or crypto trading.

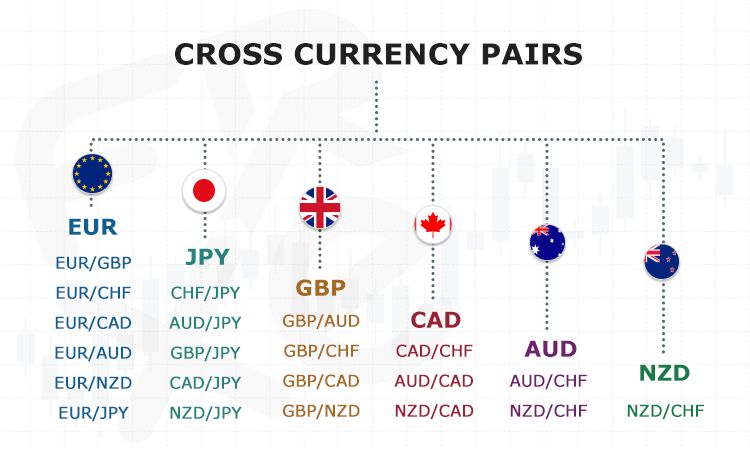

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases, it's important to do your research before making any investments. With any type or trading, it is important to manage your risk with proper diversification.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

What are the advantages and drawbacks to online investing?

The main advantage of online investing is convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

Frequently Asked Questions

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Can forex traders make any money?

Yes, forex traders are able to make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Is it possible to make a lot of money trading forex and cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. You should also trade with only the money you have the ability to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

When investing online, security is crucial. Online investments can be dangerous. You need to know the risks and how to mitigate them.

It's important to be aware of who you are dealing directly with on any investment platform or app. Reputable companies have good customer ratings and reviews. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!